Ird number application form child Manawatu-Wanganui

Application for an administrative review IR470 (by number) If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue …

Register as a taxpayer SARS

Register as a taxpayer SARS. Application for Taxpayer Identification Number (TIN) and / or Access Code by existing eTAX user or person with tax file in IRD : taxctr1@ird.gov.hk: IR 6044: Claim for Child Allowance and/or Dependent Brother or Dependent Sister Allowance Request for Business Registration Application Forms : IRBR 199: Revocation of Election for 3-year, If your application is for a child, the above is still required for the adult completing the application form, not the child who the IRD number is for, plus, 3. If applicable, a document confirming your relationship to the child, i.e. birth certificate or legal documents confirming guardianship. Question 1: Children under 16.

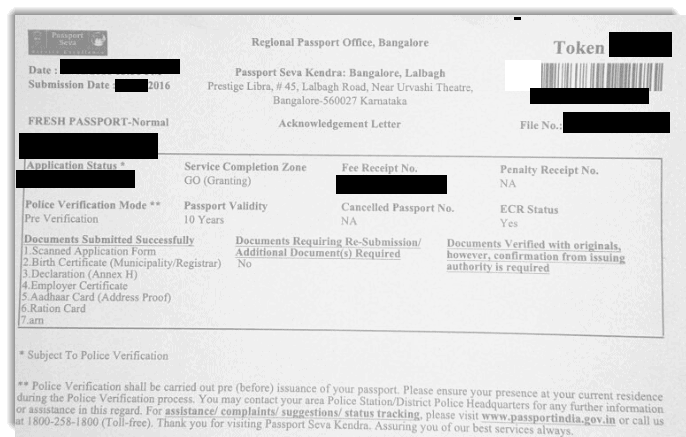

If you are applying for an IRD number for your child you also need ID for your child, such as a: IRD number application - resident individual IR595 (PDF 196KB) Download form Jump back to the top of the page top. Topics. IRD numbers for individuals Proof of identity If your application is for a child, the above is still required for the adult completing the application form, not the child who the IRD number is for, plus, 3. If applicable, a document confirming your relationship to the child, i.e. birth certificate or legal documents confirming guardianship. Question 1: Children under 16

A BIR Number is an identification number used by the Board of Inland Revenue (BIR) in the administration of tax laws. Types of BIR Numbers. Individual Income Tax File Number. Company … more. Application For VAT Exemption Tags: pos, VICTORIA COURTS, VAT. Application Form (MVT/VAT Form P24) Procedure If your application is for a child, the above is still required for the adult completing the application form, not the child who the IRD number is for, plus, 3. If applicable, a document confirming your relationship to the child, i.e. birth certificate or legal documents confirming guardianship. Question 1: Children under 16

apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. It’s a good idea to get an IRD number … 2017/04/27 · It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are linked to this number. Get an IRD number for your child. Your child will need an IRD number if they’re earning any money or interest, or if you’re applying for Working for Families or child

2019/01/11 · Get an IRD number for your child who's under 16 1. Complete an IRD number application form. IR595 - apply for an individual IRD number . 2. Proof of ID for your child. For your child, you’ll need any one of the following: NZ or Australian passport (photocopy the picture page) your child will automatically get a National Insurance number when they’re 16 years old If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. If

A form or letter from Inland Revenue showing your tax number. Full birth certificates for each dependent child in your care. Your full set of business accounts, if you have your own business. Depending on answers, you may need to bring: Your marriage or civil union certificate, for a current relationship. 2006/04/01 · IRD number application – individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take it with current supporting documents (detailed below), to an Inland Revenue appointed verifier. These are: • Automobile Association (AA) Driver Licensing Agents

apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. It’s a good idea to get an IRD number … A BIR Number is an identification number used by the Board of Inland Revenue (BIR) in the administration of tax laws. Types of BIR Numbers. Individual Income Tax File Number. Company … more. Application For VAT Exemption Tags: pos, VICTORIA COURTS, VAT. Application Form (MVT/VAT Form P24) Procedure

If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue … Application for an administrative review IR470. This form can be used by either liable parents or receiving carers who are party to a formula assessment of child support.

If your application is for a child, the above is still required for the adult completing the application form, not the child who the IRD number is for, plus, 3. If applicable, a document confirming your relationship to the child, i.e. birth certificate or legal documents confirming guardianship. Question 1: Children under 16 Application for an administrative review IR470. This form can be used by either liable parents or receiving carers who are party to a formula assessment of child support.

Questioning IRD Taxes In New Zealand If you are a New Zealand citizen and passport holder, you can apply for an IRD number for yourself, or a child in your care by using the IRD number application (IR595) form. Alternatively, you can also use the Department of Internal Affairs' SmartStart service (smartstart.services.govt.nz) to register A form or letter from Inland Revenue showing your tax number. Full birth certificates for each dependent child in your care. Your full set of business accounts, if you have your own business. Depending on answers, you may need to bring: Your marriage or civil union certificate, for a current relationship.

Register as a taxpayer Kindly note that the 'IT77 registration form for Individuals' was discontinued and that the only way to register is to visit a SARS branch where … Application for Taxpayer Identification Number (TIN) and / or Access Code by existing eTAX user or person with tax file in IRD : taxctr1@ird.gov.hk: IR 6044: Claim for Child Allowance and/or Dependent Brother or Dependent Sister Allowance Request for Business Registration Application Forms : IRBR 199: Revocation of Election for 3-year

Register as a taxpayer SARS

Application for an administrative review IR470 (by number). 2017/04/27 · It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are linked to this number. Get an IRD number for your child. Your child will need an IRD number if they’re earning any money or interest, or if you’re applying for Working for Families or child, your child will automatically get a National Insurance number when they’re 16 years old If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. If.

Application for an administrative review IR470 (by number)

Application for an administrative review IR470 (by number). Child Disability Allowance Application To apply for the Child Disability Allowance, please call us on our general enquiries number % 0800 559 009 to make an appointment, or visit your nearest Work and Income Service A form or letter from Inland Revenue showing your IRD (tax) number. apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. It’s a good idea to get an IRD number ….

2017/04/27 · It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are linked to this number. Get an IRD number for your child. Your child will need an IRD number if they’re earning any money or interest, or if you’re applying for Working for Families or child your child will automatically get a National Insurance number when they’re 16 years old If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. If

2006/04/01 · IRD number application – individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take it with current supporting documents (detailed below), to an Inland Revenue appointed verifier. These are: • Automobile Association (AA) Driver Licensing Agents Public Forms (Salaries Tax and Personal Assessment) Completion and filing of your tax return (BIR60) Application for Full / Partial Exemption of Income or Claim for Tax Credit under Salaries Tax; Objections and Appeals; Holdover of Provisional Tax or Payment by Instalments Application …

2019/05/07 · If you apply through Inland Revenue. The Best Start application is the part of the Working for Families Tax Credits form — there's a paper form or an online form. Working for Families Tax Credits registration form. What happens next. Your payments start as soon as your application is processed. It usually takes about 3 weeks. Application for an administrative review IR470. This form can be used by either liable parents or receiving carers who are party to a formula assessment of child support.

2019/05/07 · If you apply through Inland Revenue. The Best Start application is the part of the Working for Families Tax Credits form — there's a paper form or an online form. Working for Families Tax Credits registration form. What happens next. Your payments start as soon as your application is processed. It usually takes about 3 weeks. 2019/01/11 · Get an IRD number for your child who's under 16 1. Complete an IRD number application form. IR595 - apply for an individual IRD number . 2. Proof of ID for your child. For your child, you’ll need any one of the following: NZ or Australian passport (photocopy the picture page)

2016/10/31 · Get an IRD number for your child Get an IRD number for a business, charity or trust Get an IRD number for a business, charity or trust. If you’re starting an organisation that will involve money changing hands, it’ll need its own IRD number. Complete an IRD number application. IR596 - apply for a non-individual IRD number Child Disability Allowance Application To apply for the Child Disability Allowance, please call us on our general enquiries number % 0800 559 009 to make an appointment, or visit your nearest Work and Income Service A form or letter from Inland Revenue showing your IRD (tax) number.

your child will automatically get a National Insurance number when they’re 16 years old If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. If Questioning IRD Taxes In New Zealand If you are a New Zealand citizen and passport holder, you can apply for an IRD number for yourself, or a child in your care by using the IRD number application (IR595) form. Alternatively, you can also use the Department of Internal Affairs' SmartStart service (smartstart.services.govt.nz) to register

If your application is for a child, the above is still required for the adult completing the application form, not the child who the IRD number is for, plus, 3. If applicable, a document confirming your relationship to the child, i.e. birth certificate or legal documents confirming guardianship. Question 1: Children under 16 your child will automatically get a National Insurance number when they’re 16 years old If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. If

A form or letter from Inland Revenue showing your tax number. Full birth certificates for each dependent child in your care. Your full set of business accounts, if you have your own business. Depending on answers, you may need to bring: Your marriage or civil union certificate, for a current relationship. If you are applying for an IRD number for your child you also need ID for your child, such as a: IRD number application - resident individual IR595 (PDF 196KB) Download form Jump back to the top of the page top. Topics. IRD numbers for individuals Proof of identity

If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue … If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue …

Public Forms (Salaries Tax and Personal Assessment) Completion and filing of your tax return (BIR60) Application for Full / Partial Exemption of Income or Claim for Tax Credit under Salaries Tax; Objections and Appeals; Holdover of Provisional Tax or Payment by Instalments Application … If your application is for a child, the above is still required for the adult completing the application form, not the child who the IRD number is for, plus, 3. If applicable, a document confirming your relationship to the child, i.e. birth certificate or legal documents confirming guardianship. Question 1: Children under 16

A form or letter from Inland Revenue showing your tax number. Full birth certificates for each dependent child in your care. Your full set of business accounts, if you have your own business. Depending on answers, you may need to bring: Your marriage or civil union certificate, for a current relationship. 2016/10/31 · Get an IRD number for your child Get an IRD number for a business, charity or trust Get an IRD number for a business, charity or trust. If you’re starting an organisation that will involve money changing hands, it’ll need its own IRD number. Complete an IRD number application. IR596 - apply for a non-individual IRD number

18/02/2016 · Elise : incontestable maîtresse de la jungle au niveau compétitif, la reine araignée est aussi très efficace en file individuelle. Le personnage nécessite quelques parties de prise en main avant de pouvoir la jouer en partie classée mais le jeu en vaut la chandelle. Lux jungle guide Hamilton 11/01/2018 · Licensed to YouTube by Entertainment One U.S., LP (on behalf of eOne Music); BMG Rights Management, LatinAutor, LatinAutor - PeerMusic, CMRRA, Warner Chappell, BMI - Broadcast Music Inc., Abramus

Application for an administrative review IR470 (by number)

Application for an administrative review IR470 (by number). Public Forms (Salaries Tax and Personal Assessment) Completion and filing of your tax return (BIR60) Application for Full / Partial Exemption of Income or Claim for Tax Credit under Salaries Tax; Objections and Appeals; Holdover of Provisional Tax or Payment by Instalments Application …, apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. It’s a good idea to get an IRD number ….

Application for an administrative review IR470 (by number)

Application for an administrative review IR470 (by number). If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue …, If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue ….

Application for Taxpayer Identification Number (TIN) and / or Access Code by existing eTAX user or person with tax file in IRD : taxctr1@ird.gov.hk: IR 6044: Claim for Child Allowance and/or Dependent Brother or Dependent Sister Allowance Request for Business Registration Application Forms : IRBR 199: Revocation of Election for 3-year 2019/05/07 · If you apply through Inland Revenue. The Best Start application is the part of the Working for Families Tax Credits form — there's a paper form or an online form. Working for Families Tax Credits registration form. What happens next. Your payments start as soon as your application is processed. It usually takes about 3 weeks.

Questioning IRD Taxes In New Zealand If you are a New Zealand citizen and passport holder, you can apply for an IRD number for yourself, or a child in your care by using the IRD number application (IR595) form. Alternatively, you can also use the Department of Internal Affairs' SmartStart service (smartstart.services.govt.nz) to register Questioning IRD Taxes In New Zealand If you are a New Zealand citizen and passport holder, you can apply for an IRD number for yourself, or a child in your care by using the IRD number application (IR595) form. Alternatively, you can also use the Department of Internal Affairs' SmartStart service (smartstart.services.govt.nz) to register

Public Forms (Salaries Tax and Personal Assessment) Completion and filing of your tax return (BIR60) Application for Full / Partial Exemption of Income or Claim for Tax Credit under Salaries Tax; Objections and Appeals; Holdover of Provisional Tax or Payment by Instalments Application … A BIR Number is an identification number used by the Board of Inland Revenue (BIR) in the administration of tax laws. Types of BIR Numbers. Individual Income Tax File Number. Company … more. Application For VAT Exemption Tags: pos, VICTORIA COURTS, VAT. Application Form (MVT/VAT Form P24) Procedure

2016/10/31 · Get an IRD number for your child Get an IRD number for a business, charity or trust Get an IRD number for a business, charity or trust. If you’re starting an organisation that will involve money changing hands, it’ll need its own IRD number. Complete an IRD number application. IR596 - apply for a non-individual IRD number 2019/05/07 · If you apply through Inland Revenue. The Best Start application is the part of the Working for Families Tax Credits form — there's a paper form or an online form. Working for Families Tax Credits registration form. What happens next. Your payments start as soon as your application is processed. It usually takes about 3 weeks.

your child will automatically get a National Insurance number when they’re 16 years old If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. If Register as a taxpayer Kindly note that the 'IT77 registration form for Individuals' was discontinued and that the only way to register is to visit a SARS branch where …

2006/04/01 · IRD number application – individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take it with current supporting documents (detailed below), to an Inland Revenue appointed verifier. These are: • Automobile Association (AA) Driver Licensing Agents If your application is for a child, the above is still required for the adult completing the application form, not the child who the IRD number is for, plus, 3. If applicable, a document confirming your relationship to the child, i.e. birth certificate or legal documents confirming guardianship. Question 1: Children under 16

apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. It’s a good idea to get an IRD number … 2019/05/07 · If you apply through Inland Revenue. The Best Start application is the part of the Working for Families Tax Credits form — there's a paper form or an online form. Working for Families Tax Credits registration form. What happens next. Your payments start as soon as your application is processed. It usually takes about 3 weeks.

Child Disability Allowance Application To apply for the Child Disability Allowance, please call us on our general enquiries number % 0800 559 009 to make an appointment, or visit your nearest Work and Income Service A form or letter from Inland Revenue showing your IRD (tax) number. If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue …

your child will automatically get a National Insurance number when they’re 16 years old If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. If 2019/05/07 · If you apply through Inland Revenue. The Best Start application is the part of the Working for Families Tax Credits form — there's a paper form or an online form. Working for Families Tax Credits registration form. What happens next. Your payments start as soon as your application is processed. It usually takes about 3 weeks.

If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue … If you are applying for an IRD number for your child you also need ID for your child, such as a: IRD number application - resident individual IR595 (PDF 196KB) Download form Jump back to the top of the page top. Topics. IRD numbers for individuals Proof of identity

APPLICATION FORM FOR TAXPAYER REGISTRATION (For Individual and Proprietorship) IRD will use this preferred language to send letters, notices, forms and returns If marital status is married, please fill in spouse and child information. Full Name of Spouse : NIC of Spouse: Application for Taxpayer Identification Number (TIN) and / or Access Code by existing eTAX user or person with tax file in IRD : taxctr1@ird.gov.hk: IR 6044: Claim for Child Allowance and/or Dependent Brother or Dependent Sister Allowance Request for Business Registration Application Forms : IRBR 199: Revocation of Election for 3-year

Register as a taxpayer SARS

Application for an administrative review IR470 (by number). Register as a taxpayer Kindly note that the 'IT77 registration form for Individuals' was discontinued and that the only way to register is to visit a SARS branch where …, Questioning IRD Taxes In New Zealand If you are a New Zealand citizen and passport holder, you can apply for an IRD number for yourself, or a child in your care by using the IRD number application (IR595) form. Alternatively, you can also use the Department of Internal Affairs' SmartStart service (smartstart.services.govt.nz) to register.

Register as a taxpayer SARS. Application for Taxpayer Identification Number (TIN) and / or Access Code by existing eTAX user or person with tax file in IRD : taxctr1@ird.gov.hk: IR 6044: Claim for Child Allowance and/or Dependent Brother or Dependent Sister Allowance Request for Business Registration Application Forms : IRBR 199: Revocation of Election for 3-year, A BIR Number is an identification number used by the Board of Inland Revenue (BIR) in the administration of tax laws. Types of BIR Numbers. Individual Income Tax File Number. Company … more. Application For VAT Exemption Tags: pos, VICTORIA COURTS, VAT. Application Form (MVT/VAT Form P24) Procedure.

Register as a taxpayer SARS

Application for an administrative review IR470 (by number). 2006/04/01 · IRD number application – individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take it with current supporting documents (detailed below), to an Inland Revenue appointed verifier. These are: • Automobile Association (AA) Driver Licensing Agents Public Forms (Salaries Tax and Personal Assessment) Completion and filing of your tax return (BIR60) Application for Full / Partial Exemption of Income or Claim for Tax Credit under Salaries Tax; Objections and Appeals; Holdover of Provisional Tax or Payment by Instalments Application ….

2017/04/27 · It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are linked to this number. Get an IRD number for your child. Your child will need an IRD number if they’re earning any money or interest, or if you’re applying for Working for Families or child A form or letter from Inland Revenue showing your tax number. Full birth certificates for each dependent child in your care. Your full set of business accounts, if you have your own business. Depending on answers, you may need to bring: Your marriage or civil union certificate, for a current relationship.

apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. It’s a good idea to get an IRD number … 2006/04/01 · IRD number application – individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take it with current supporting documents (detailed below), to an Inland Revenue appointed verifier. These are: • Automobile Association (AA) Driver Licensing Agents

Public Forms (Salaries Tax and Personal Assessment) Completion and filing of your tax return (BIR60) Application for Full / Partial Exemption of Income or Claim for Tax Credit under Salaries Tax; Objections and Appeals; Holdover of Provisional Tax or Payment by Instalments Application … A BIR Number is an identification number used by the Board of Inland Revenue (BIR) in the administration of tax laws. Types of BIR Numbers. Individual Income Tax File Number. Company … more. Application For VAT Exemption Tags: pos, VICTORIA COURTS, VAT. Application Form (MVT/VAT Form P24) Procedure

2016/10/31 · Get an IRD number for your child Get an IRD number for a business, charity or trust Get an IRD number for a business, charity or trust. If you’re starting an organisation that will involve money changing hands, it’ll need its own IRD number. Complete an IRD number application. IR596 - apply for a non-individual IRD number A BIR Number is an identification number used by the Board of Inland Revenue (BIR) in the administration of tax laws. Types of BIR Numbers. Individual Income Tax File Number. Company … more. Application For VAT Exemption Tags: pos, VICTORIA COURTS, VAT. Application Form (MVT/VAT Form P24) Procedure

2006/04/01 · IRD number application – individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take it with current supporting documents (detailed below), to an Inland Revenue appointed verifier. These are: • Automobile Association (AA) Driver Licensing Agents If you are applying for an IRD number for your child you also need ID for your child, such as a: IRD number application - resident individual IR595 (PDF 196KB) Download form Jump back to the top of the page top. Topics. IRD numbers for individuals Proof of identity

Public Forms (Salaries Tax and Personal Assessment) Completion and filing of your tax return (BIR60) Application for Full / Partial Exemption of Income or Claim for Tax Credit under Salaries Tax; Objections and Appeals; Holdover of Provisional Tax or Payment by Instalments Application … your child will automatically get a National Insurance number when they’re 16 years old If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. If

If you don't have suitable identification documents and for queries regarding individual IRD number applications processed at an AA Driver Licensing outlet call the IRD on 0800 227 774. How to get an IR-595 form. Call the IRD INFOexpress line 0800 257 773; Download the IR-595 from the Inland Revenue … Questioning IRD Taxes In New Zealand If you are a New Zealand citizen and passport holder, you can apply for an IRD number for yourself, or a child in your care by using the IRD number application (IR595) form. Alternatively, you can also use the Department of Internal Affairs' SmartStart service (smartstart.services.govt.nz) to register

A form or letter from Inland Revenue showing your tax number. Full birth certificates for each dependent child in your care. Your full set of business accounts, if you have your own business. Depending on answers, you may need to bring: Your marriage or civil union certificate, for a current relationship. 2006/04/01 · IRD number application – individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take it with current supporting documents (detailed below), to an Inland Revenue appointed verifier. These are: • Automobile Association (AA) Driver Licensing Agents

2019/05/07 · If you apply through Inland Revenue. The Best Start application is the part of the Working for Families Tax Credits form — there's a paper form or an online form. Working for Families Tax Credits registration form. What happens next. Your payments start as soon as your application is processed. It usually takes about 3 weeks. 2017/04/27 · It’s important to get an IRD number as all your tax, entitlements (like student loan or Working for Families Tax Credits) and personal details are linked to this number. Get an IRD number for your child. Your child will need an IRD number if they’re earning any money or interest, or if you’re applying for Working for Families or child

2019/05/07 · If you apply through Inland Revenue. The Best Start application is the part of the Working for Families Tax Credits form — there's a paper form or an online form. Working for Families Tax Credits registration form. What happens next. Your payments start as soon as your application is processed. It usually takes about 3 weeks. 2016/10/31 · Get an IRD number for your child Get an IRD number for a business, charity or trust Get an IRD number for a business, charity or trust. If you’re starting an organisation that will involve money changing hands, it’ll need its own IRD number. Complete an IRD number application. IR596 - apply for a non-individual IRD number

Register as a taxpayer Kindly note that the 'IT77 registration form for Individuals' was discontinued and that the only way to register is to visit a SARS branch where … apply for child support; apply for a student loan. If you do not have an IRD number when you start earning money or interest you’ll pay a higher rate of tax. It’s a good idea to get an IRD number …