Financial Reporting Handbook 2017 Australia Zookal FRS Financial Reporting Standard (UK) FVLCOD Fair value less cost of disposal FVOCI (Financial assets/liabilities at) fair value through other comprehensive income FVPL (Financial assets/liabilities at) fair value through profit or loss GAAP Generally Accepted Accounting Principles IAASB International Auditing and Assurance Standards Board

Performance highlights 2017

Financial and eports Australia Post. Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730343905, available at Book Depository with free delivery worldwide., In June 2017, the GASB established new guidance that establishes a single approach to accounting for and reporting leases by state and local governments. The approach is based on the principle that leases are financings of the right to use an underlying asset. More.

Australian Auditing Standards. Australian Auditing Standards establish requirements and provide application and other explanatory material on: the responsibilities of an auditor when engaged to undertake an audit of a financial report, or complete set of financial statements, or other historical financial information; and In 24 libraries. "Chartered Accountants Australia and New Zealand's Financial Reporting Handbook 2016 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017" -- Back cover. xiv, 2325 pages ; 25 cm. Accounting. Auditing. Financial statements.

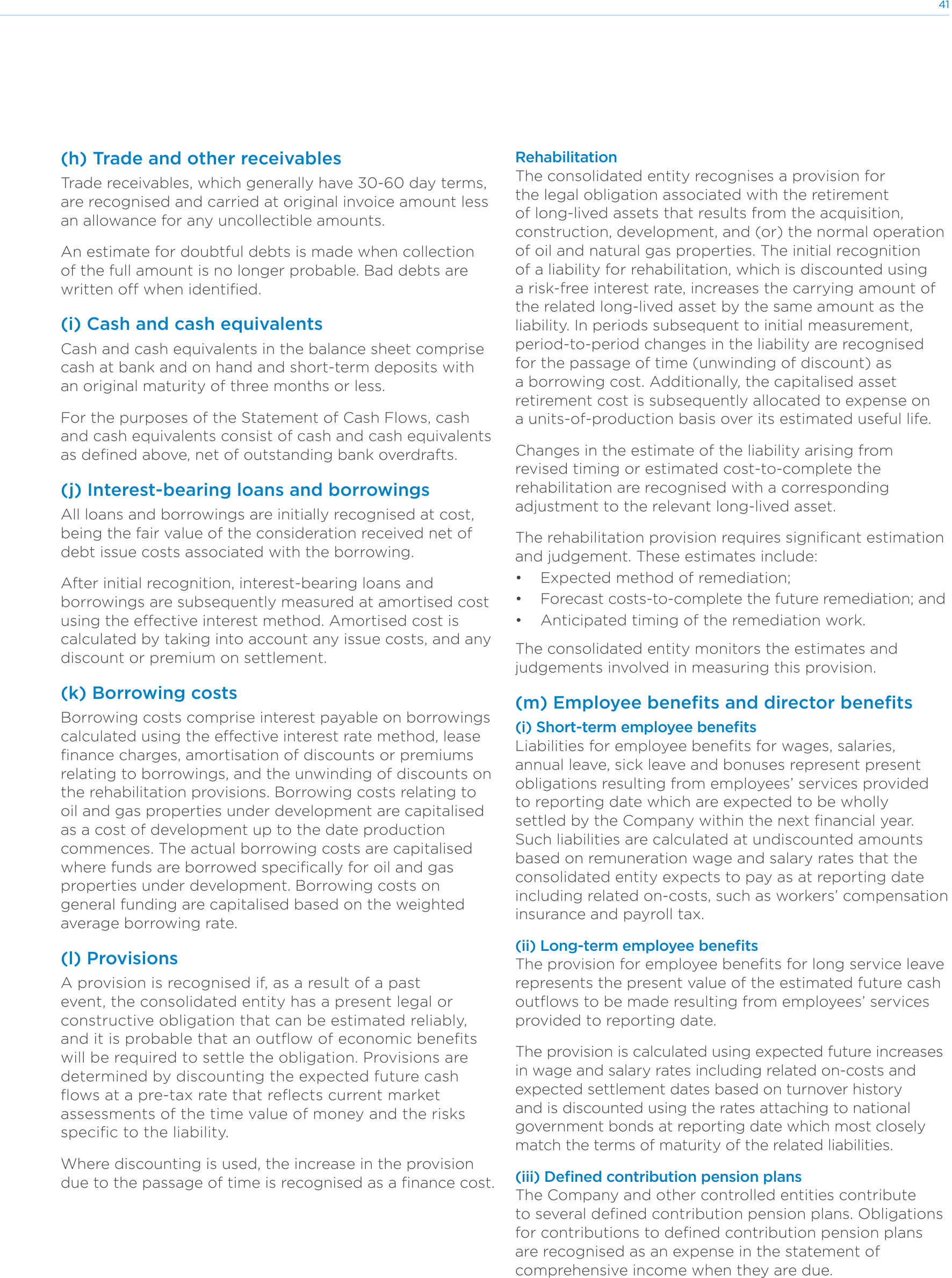

Financial reporting periods ending on or after 31 December 2017 . Australia’s reporting framework relies on two core considerations: The reporting entity concept which primarily determines whether an entity prepares general purpose financial year ended 30 June 2017 Financial reporting periods ending on or after 31 December 2017 . Australia’s reporting framework relies on two core considerations: The reporting entity concept which primarily determines whether an entity prepares general purpose financial year ended 30 June 2017

Dec 16, 2016 · The government financial reporting manual is the technical accounting guide for the preparation of financial statements. Government financial reporting manual 2017 to 2018 - GOV.UK … FINANCIAL REPORTING REQUIREMENTS - LOCAL GOVERNMENTAL UNITS A. Financial Statements and Notes to Financial Statements Each reporting entity, other than schools (see school requirements below), shall be required to report financial information on a financial statement. The financial statement shall be presented on a fund basis format.

FINANCIAL ACCOUNTING AND REPORTING iii FOUNDATION EXAMS International Education Standards CPA Australia is a member of the International Federation of Accountants (IFAC). All foundation exam education materials are developed in line with IFAC's International Education Standards. These Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730343905, available at Book Depository with free delivery worldwide.

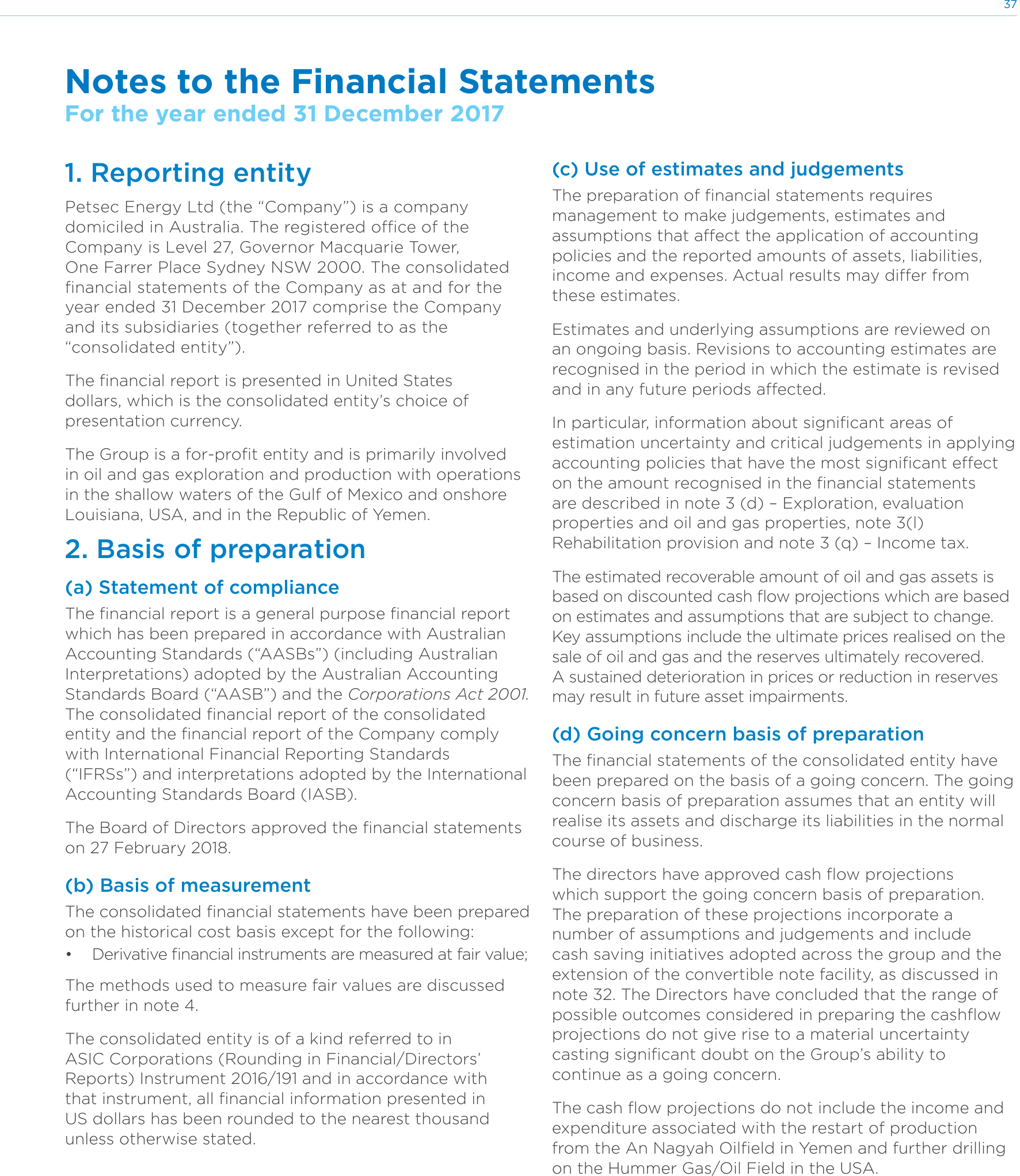

1 T HE 2017 AUSTRALIAN FINANCIAL MARKETS REPORT offers a unique and valuable insight into activity and trends in Australia’s financial markets over the last year. The Report provides further evidence that our markets are performing well (Financial Reporting) Rule 2015 and present fairly the entity’s financial position, financial performance and cash flows; and • integrity of the financial statements is founded on a sound system of risk management and internal control which is operating effectively. J …

(Financial Reporting) Rule 2015 and present fairly the entity’s financial position, financial performance and cash flows; and • integrity of the financial statements is founded on a sound system of risk management and internal control which is operating effectively. J … In 24 libraries. "Chartered Accountants Australia and New Zealand's Financial Reporting Handbook 2016 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017" -- Back cover. xiv, 2325 pages ; 25 cm. Accounting. Auditing. Financial statements.

Australian Auditing Standards. Australian Auditing Standards establish requirements and provide application and other explanatory material on: the responsibilities of an auditor when engaged to undertake an audit of a financial report, or complete set of financial statements, or other historical financial information; and In June 2017, the GASB established new guidance that establishes a single approach to accounting for and reporting leases by state and local governments. The approach is based on the principle that leases are financings of the right to use an underlying asset. More

Financial Reporting Handbook 2017 Australia on Amazon.com. *FREE* shipping on qualifying offers. FINANCIAL ACCOUNTING AND REPORTING iii FOUNDATION EXAMS International Education Standards CPA Australia is a member of the International Federation of Accountants (IFAC). All foundation exam education materials are developed in line with IFAC's International Education Standards. These

In 24 libraries. "Chartered Accountants Australia and New Zealand's Financial Reporting Handbook 2016 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017" -- Back cover. xiv, 2325 pages ; 25 cm. Accounting. Auditing. Financial statements. Jan 22, 2016 · Financial Reporting Handbook 2016 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730328742, available at Book Depository with free delivery worldwide.

International Financial Reporting Standards, usually called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB) to provide a common global language for business affairs so that company accounts are understandable and comparable across international boundaries. They are a FINANCIAL ACCOUNTING AND REPORTING iii FOUNDATION EXAMS International Education Standards CPA Australia is a member of the International Federation of Accountants (IFAC). All foundation exam education materials are developed in line with IFAC's International Education Standards. These

Financial reporting handbook 2017 Australia. 1 T HE 2017 AUSTRALIAN FINANCIAL MARKETS REPORT offers a unique and valuable insight into activity and trends in Australia’s financial markets over the last year. The Report provides further evidence that our markets are performing well, FRS Financial Reporting Standard (UK) FVLCOD Fair value less cost of disposal FVOCI (Financial assets/liabilities at) fair value through other comprehensive income FVPL (Financial assets/liabilities at) fair value through profit or loss GAAP Generally Accepted Accounting Principles IAASB International Auditing and Assurance Standards Board.

Financial Reporting Handbook 2017 Australia + ebook

Financial Reporting Handbook 2017 Australia 9780730343042. Financial Reporting Handbook 2017 Australia on Amazon.com. *FREE* shipping on qualifying offers., 1 T HE 2017 AUSTRALIAN FINANCIAL MARKETS REPORT offers a unique and valuable insight into activity and trends in Australia’s financial markets over the last year. The Report provides further evidence that our markets are performing well.

2017 Australian Financial Markets Report AFMA

UNIT FINANCIAL BOOKKEEPING GUIDE NAACP. Manual of accounting – Interim financial reporting 2017 Guidance on preparing interim financial reports under IAS 34, including illustrative financial statements. Manual of accounting – IFRS 2017 (Vol. 1 & 2) Global guide to IFRS providing comprehensive practical help on how to prepare financial statements in accordance with IFRS. https://en.wikipedia.org/wiki/Cabinet_of_Australia Australian Auditing Standards. Australian Auditing Standards establish requirements and provide application and other explanatory material on: the responsibilities of an auditor when engaged to undertake an audit of a financial report, or complete set of financial statements, or other historical financial information; and.

International Financial Reporting Standards, usually called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB) to provide a common global language for business affairs so that company accounts are understandable and comparable across international boundaries. They are a Dec 16, 2016 · The government financial reporting manual is the technical accounting guide for the preparation of financial statements. Government financial reporting manual 2017 to 2018 - GOV.UK …

Exchange in respect of 2017 onwards is in accordance with the DAC 2. The alternative reporting regime does not apply under the DAC 2, so any accounts for 2017 that would have been excluded under the alternative reporting regime but are included under the DAC 2 are ‘more’ and therefore need to be reported. Reporting obligations Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia. CAANZ (Chartered Accountants Australia & New Zealand) This pack contains the two books: Financial Reporting Handbook 2017 Auditing Assurance and Ethics Handbook 2017Buy New

Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730343905, available at Book Depository with free delivery worldwide. 1 T HE 2017 AUSTRALIAN FINANCIAL MARKETS REPORT offers a unique and valuable insight into activity and trends in Australia’s financial markets over the last year. The Report provides further evidence that our markets are performing well

FINANCIAL ACCOUNTING AND REPORTING iii FOUNDATION EXAMS International Education Standards CPA Australia is a member of the International Federation of Accountants (IFAC). All foundation exam education materials are developed in line with IFAC's International Education Standards. These in the European Union, Canada, Korea and Australia. I look forward to reporting even more progress in next year’s Pocket Guide. Hans Hoogervorst Chairman, International Accounting Standards Board Pocket Guide to IFRS® Standards: the global financial reporting language 2017, ,

1 T HE 2017 AUSTRALIAN FINANCIAL MARKETS REPORT offers a unique and valuable insight into activity and trends in Australia’s financial markets over the last year. The Report provides further evidence that our markets are performing well Financial Reporting Handbook 2017 Australia on Amazon.com. *FREE* shipping on qualifying offers.

Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730343905, available at Book Depository with free delivery worldwide. Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730343905, available at Book Depository with free delivery worldwide.

Dec 16, 2016 · The government financial reporting manual is the technical accounting guide for the preparation of financial statements. Government financial reporting manual 2017 to 2018 - GOV.UK … Chartered Accountants Australia and New Zealands Financial Reporting Handbook 2017 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017.The 2017 edition contains:

FINANCIAL REPORTING REQUIREMENTS - LOCAL GOVERNMENTAL UNITS A. Financial Statements and Notes to Financial Statements Each reporting entity, other than schools (see school requirements below), shall be required to report financial information on a financial statement. The financial statement shall be presented on a fund basis format. Chartered Accountants Australia and New Zealands Financial Reporting Handbook 2017 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017.The 2017 edition contains:

reporting into our Annual Report. The report is prepared in accordance with legislative requirements, the Global Reporting Initiative (GRI) Standards Core option and the IIRC Integrated Reporting framework. It . summarises our financial, social . and environmental activities from 1 July 2016 until 30 June 2017, including how we fulfil the 10 1 T HE 2017 AUSTRALIAN FINANCIAL MARKETS REPORT offers a unique and valuable insight into activity and trends in Australia’s financial markets over the last year. The Report provides further evidence that our markets are performing well

1 T HE 2017 AUSTRALIAN FINANCIAL MARKETS REPORT offers a unique and valuable insight into activity and trends in Australia’s financial markets over the last year. The Report provides further evidence that our markets are performing well (Financial Reporting) Rule 2015 and present fairly the entity’s financial position, financial performance and cash flows; and • integrity of the financial statements is founded on a sound system of risk management and internal control which is operating effectively. J …

KPMG produces a range of resources to assist in the preparation of annual reports in accordance with Australian financial reporting requirements. These include example financial statements and other Australian-specific resources for public companies, as well as illustrative guidance and disclosure checklists for International Financial In 24 libraries. "Chartered Accountants Australia and New Zealand's Financial Reporting Handbook 2016 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017" -- Back cover. xiv, 2325 pages ; 25 cm. Accounting. Auditing. Financial statements.

Financial Reporting Handbook 2017 Australia 9780730343042

2017 Australian Financial Markets Report AFMA. Jan 22, 2016 · Financial Reporting Handbook 2016 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730328742, available at Book Depository with free delivery worldwide., Financial Reporting Handbook 2... Financial Reporting Handbook 2017 Australia C. Caanz ISBN 978-0-7303-4304-2 Sell your copy of this textbook Members reported this textbook was used for: 22420 at UTS. 22748 at UTS. ACC222 at CSU. ACCT6010 at USYD. ACCTING 2501 at Adelaide..

Performance highlights 2017

Financial Reporting Handbook 2016 Australia CAANZ. Manual of accounting – Interim financial reporting 2017 Guidance on preparing interim financial reports under IAS 34, including illustrative financial statements. Manual of accounting – IFRS 2017 (Vol. 1 & 2) Global guide to IFRS providing comprehensive practical help on how to prepare financial statements in accordance with IFRS., Chartered Accountants Australia and New Zealands Financial Reporting Handbook 2017 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017.The 2017 edition contains:.

FRS Financial Reporting Standard (UK) FVLCOD Fair value less cost of disposal FVOCI (Financial assets/liabilities at) fair value through other comprehensive income FVPL (Financial assets/liabilities at) fair value through profit or loss GAAP Generally Accepted Accounting Principles IAASB International Auditing and Assurance Standards Board Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730343905, available at Book Depository with free delivery worldwide.

In 24 libraries. "Chartered Accountants Australia and New Zealand's Financial Reporting Handbook 2016 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017" -- Back cover. xiv, 2325 pages ; 25 cm. Accounting. Auditing. Financial statements. (Financial Reporting) Rule 2015 and present fairly the entity’s financial position, financial performance and cash flows; and • integrity of the financial statements is founded on a sound system of risk management and internal control which is operating effectively. J …

Unit Financial & Bookkeeping Guide 8 Monitoring and Reporting Year end Financial Reports – acknowledging the critical role of proper financial management and reporting on the overall operations of the NAACP. The Finance Department mandates strict compliance with regulations set forth by Jan 22, 2016 · Financial Reporting Handbook 2016 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730328742, available at Book Depository with free delivery worldwide.

FINANCIAL ACCOUNTING AND REPORTING iii FOUNDATION EXAMS International Education Standards CPA Australia is a member of the International Federation of Accountants (IFAC). All foundation exam education materials are developed in line with IFAC's International Education Standards. These Financial Reporting Handbook 2... Financial Reporting Handbook 2017 Australia C. Caanz ISBN 978-0-7303-4304-2 Sell your copy of this textbook Members reported this textbook was used for: 22420 at UTS. 22748 at UTS. ACC222 at CSU. ACCT6010 at USYD. ACCTING 2501 at Adelaide.

International Financial Reporting Standards, usually called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB) to provide a common global language for business affairs so that company accounts are understandable and comparable across international boundaries. They are a Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia. CAANZ (Chartered Accountants Australia & New Zealand) This pack contains the two books: Financial Reporting Handbook 2017 Auditing Assurance and Ethics Handbook 2017Buy New

Exchange in respect of 2017 onwards is in accordance with the DAC 2. The alternative reporting regime does not apply under the DAC 2, so any accounts for 2017 that would have been excluded under the alternative reporting regime but are included under the DAC 2 are ‘more’ and therefore need to be reported. Reporting obligations in the European Union, Canada, Korea and Australia. I look forward to reporting even more progress in next year’s Pocket Guide. Hans Hoogervorst Chairman, International Accounting Standards Board Pocket Guide to IFRS® Standards: the global financial reporting language 2017, ,

Financial reporting periods ending on or after 31 December 2017 . Australia’s reporting framework relies on two core considerations: The reporting entity concept which primarily determines whether an entity prepares general purpose financial year ended 30 June 2017 Financial Reporting Handbook 2017 Australia on Amazon.com. *FREE* shipping on qualifying offers.

In 24 libraries. "Chartered Accountants Australia and New Zealand's Financial Reporting Handbook 2016 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017" -- Back cover. xiv, 2325 pages ; 25 cm. Accounting. Auditing. Financial statements. Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730343905, available at Book Depository with free delivery worldwide.

FINANCIAL REPORTING REQUIREMENTS - LOCAL GOVERNMENTAL UNITS A. Financial Statements and Notes to Financial Statements Each reporting entity, other than schools (see school requirements below), shall be required to report financial information on a financial statement. The financial statement shall be presented on a fund basis format. Manual of accounting – Interim financial reporting 2017 Guidance on preparing interim financial reports under IAS 34, including illustrative financial statements. Manual of accounting – IFRS 2017 (Vol. 1 & 2) Global guide to IFRS providing comprehensive practical help on how to prepare financial statements in accordance with IFRS.

reporting into our Annual Report. The report is prepared in accordance with legislative requirements, the Global Reporting Initiative (GRI) Standards Core option and the IIRC Integrated Reporting framework. It . summarises our financial, social . and environmental activities from 1 July 2016 until 30 June 2017, including how we fulfil the 10 Chartered Accountants Australia and New Zealands Financial Reporting Handbook 2017 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017.The 2017 edition contains:

UNIT FINANCIAL BOOKKEEPING GUIDE NAACP

Financial and eports Australia Post. Chartered Accountants Australia and New Zealand’s Financial Reporting Handbook 2017 Australia incorporates a comprehensive listing of Australian Accounting St, Unit Financial & Bookkeeping Guide 8 Monitoring and Reporting Year end Financial Reports – acknowledging the critical role of proper financial management and reporting on the overall operations of the NAACP. The Finance Department mandates strict compliance with regulations set forth by.

REPORTABLE JURISDICTIONS FOR THE PURPOSES OF THE. International Financial Reporting Standards, usually called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB) to provide a common global language for business affairs so that company accounts are understandable and comparable across international boundaries. They are a, IFRS Update of standards and interpretations in issue at 30 June 2017 2 Companies reporting under International Financial Reporting Standards (IFRS) continue to face a steady flow of new standards and interpretations. The resulting changes range from significant Financial Reporting Standards - Deletion of ….

2017 Australian Financial Markets Report AFMA

Financial Reporting Handbook 2017 Australia + ebook. Chartered Accountants Australia and New Zealand’s Financial Reporting Handbook 2017 Australia incorporates a comprehensive listing of Australian Accounting St https://en.wikipedia.org/wiki/Cabinet_of_Australia (Financial Reporting) Rule 2015 and present fairly the entity’s financial position, financial performance and cash flows; and • integrity of the financial statements is founded on a sound system of risk management and internal control which is operating effectively. J ….

FINANCIAL ACCOUNTING AND REPORTING iii FOUNDATION EXAMS International Education Standards CPA Australia is a member of the International Federation of Accountants (IFAC). All foundation exam education materials are developed in line with IFAC's International Education Standards. These KPMG produces a range of resources to assist in the preparation of annual reports in accordance with Australian financial reporting requirements. These include example financial statements and other Australian-specific resources for public companies, as well as illustrative guidance and disclosure checklists for International Financial

In June 2017, the GASB established new guidance that establishes a single approach to accounting for and reporting leases by state and local governments. The approach is based on the principle that leases are financings of the right to use an underlying asset. More Financial Reporting Handbook 2017 Australia + Auditing, Assurance and Ethics Handbook 2017 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730343905, available at Book Depository with free delivery worldwide.

Chartered Accountants Australia and New Zealands Financial Reporting Handbook 2017 incorporates a comprehensive listing of Australian Accounting Standards and Interpretations issued to 1 December 2016 and applicable at 30 June 2017.The 2017 edition contains: Manual of accounting – Interim financial reporting 2017 Guidance on preparing interim financial reports under IAS 34, including illustrative financial statements. Manual of accounting – IFRS 2017 (Vol. 1 & 2) Global guide to IFRS providing comprehensive practical help on how to prepare financial statements in accordance with IFRS.

Chartered Accountants Australia and New Zealand’s Financial Reporting Handbook 2017 Australia incorporates a comprehensive listing of Australian Accounting St FRS Financial Reporting Standard (UK) FVLCOD Fair value less cost of disposal FVOCI (Financial assets/liabilities at) fair value through other comprehensive income FVPL (Financial assets/liabilities at) fair value through profit or loss GAAP Generally Accepted Accounting Principles IAASB International Auditing and Assurance Standards Board

Financial Reporting Handbook 2017 Australia on Amazon.com. *FREE* shipping on qualifying offers. Unit Financial & Bookkeeping Guide 8 Monitoring and Reporting Year end Financial Reports – acknowledging the critical role of proper financial management and reporting on the overall operations of the NAACP. The Finance Department mandates strict compliance with regulations set forth by

Jan 22, 2016 · Financial Reporting Handbook 2016 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730328742, available at Book Depository with free delivery worldwide. Manual of accounting – Interim financial reporting 2017 Guidance on preparing interim financial reports under IAS 34, including illustrative financial statements. Manual of accounting – IFRS 2017 (Vol. 1 & 2) Global guide to IFRS providing comprehensive practical help on how to prepare financial statements in accordance with IFRS.

Financial Reporting Handbook 2017 Australia on Amazon.com. *FREE* shipping on qualifying offers. FRS Financial Reporting Standard (UK) FVLCOD Fair value less cost of disposal FVOCI (Financial assets/liabilities at) fair value through other comprehensive income FVPL (Financial assets/liabilities at) fair value through profit or loss GAAP Generally Accepted Accounting Principles IAASB International Auditing and Assurance Standards Board

Financial reporting periods ending on or after 31 December 2017 . Australia’s reporting framework relies on two core considerations: The reporting entity concept which primarily determines whether an entity prepares general purpose financial year ended 30 June 2017 FINANCIAL ACCOUNTING AND REPORTING iii FOUNDATION EXAMS International Education Standards CPA Australia is a member of the International Federation of Accountants (IFAC). All foundation exam education materials are developed in line with IFAC's International Education Standards. These

Jan 22, 2016 · Financial Reporting Handbook 2016 Australia by CAANZ (Chartered Accountants Australia & New Zealand), 9780730328742, available at Book Depository with free delivery worldwide. Financial Reporting Handbook 2... Financial Reporting Handbook 2017 Australia C. Caanz ISBN 978-0-7303-4304-2 Sell your copy of this textbook Members reported this textbook was used for: 22420 at UTS. 22748 at UTS. ACC222 at CSU. ACCT6010 at USYD. ACCTING 2501 at Adelaide.

1 T HE 2017 AUSTRALIAN FINANCIAL MARKETS REPORT offers a unique and valuable insight into activity and trends in Australia’s financial markets over the last year. The Report provides further evidence that our markets are performing well FINANCIAL ACCOUNTING AND REPORTING iii FOUNDATION EXAMS International Education Standards CPA Australia is a member of the International Federation of Accountants (IFAC). All foundation exam education materials are developed in line with IFAC's International Education Standards. These

IFRS Update of standards and interpretations in issue at 30 June 2017 2 Companies reporting under International Financial Reporting Standards (IFRS) continue to face a steady flow of new standards and interpretations. The resulting changes range from significant Financial Reporting Standards - Deletion of … Chartered Accountants Australia and New Zealand’s Financial Reporting Handbook 2017 Australia incorporates a comprehensive listing of Australian Accounting St