IFRS 15 Revenue from Contracts Feedback Statement A CONCISE INTRODUCTION TO IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS INTRODUCTION TheInternational Accounting Standards Board published IFRS 15 in 2014, revised the effective date in 2015 and issued clarifications in 2016. IFRS 15 contains comprehensive guidance for accounting for revenue and will replace existing requirements which are

Guide to annual financial statements – IFRS 15 supplement

IFRS 15 Revenue from Contracts Feedback Statement. that date by entities that also apply IFRS 15 Revenue from Contracts with Customers. IFRS 16 sets out a comprehensive model for the identification of lease arrangements and their treatment in the financial statements of both lessees and lessors. Leases A guide to IFRS 16, Well, because under new IFRS 15, the transaction price must be allocated to the individual performance obligations in the contract and recognized when these obligations are delivered or fulfilled. It means that under new IFRS 15, telecom operator must allocate a part of the revenue from prepayment plan with free handset to the sale of handset, too..

Clarifications to IFRS 15 Revenue from Contracts with Customers is issued by the International Accounting Standards Board® (the Board). Disclaimer: the Board, the IFRS® Foundation, the authors and the publishers do not accept responsibility for any loss caused by acting or refraining from acting in reliance on the material in this IFRS at a Glance has been compiled to assist in gaining a high level overview of International Financial Reporting Standards (IFRSs), including International Accounting Standards and Interpretations. Please click the links below to access individual 'IFRS at a Glance' pdf files per standard.

IFRS 15 Revenue from Contracts with Customers was developed jointly by the IASB and the FASB (the Boards). The Standard applies to revenue from contracts with customers only. Project history On 24 June 2010, the Boards published their first exposure draft Revenue from Contracts with Customers for … The IASB published the new IFRS 15 Revenue from contracts with customer's standard, in order to create a single model for revenue recognition for contracts. IFRS 15 will promote greater consistency and comparability across industries and capital markets.

Clarifications to IFRS 15 Revenue from Contracts with Customers is issued by the International Accounting Standards Board® (the Board). Disclaimer: the Board, the IFRS® Foundation, the authors and the publishers do not accept responsibility for any loss caused by acting or refraining from acting in reliance on the material in this IFRS 15 Revenue from Contracts with Customers Guide This communication contains a general overview of this topic and is current as of December 20, 2016. The application of the principles addressed will depend upon the particular facts and circumstances of each individual case.

IFRS 15 Revenue from Contracts with Customers is published by the International Accounting Standards Board (IASB). Disclaimer: the IASB, the IFRS Foundation, the authors and the publishers do not accept responsibility for any loss caused by acting or refraining from acting in reliance on the Paragraph 10 of IFRS 15: “A contract is an agreement between two or more parties that creates enforceable rights and obligations. Enforceability of the rights and obligations in a contract is a matter of law. Contracts can be written, oral or implied by an entity’s customary business practices.

IFRS 15 Revenue from Contracts with Customers May 2014 An overview of IFRS 15—a framework for recognising revenue IFRS 15 establishes a comprehensive framework for determining when to recognise revenue and how much revenue to recognise. The core principle in that framework is that a company should recognise revenue to • IFRS 15 also specifies the accounting treatment for certain items not typically thought of as revenue, such as certain costs associated with obtaining and fulfilling a contract and the sale of certain non-financial assets. 7 Updated October 2017 A closer look at the new revenue recognition standard . 1.

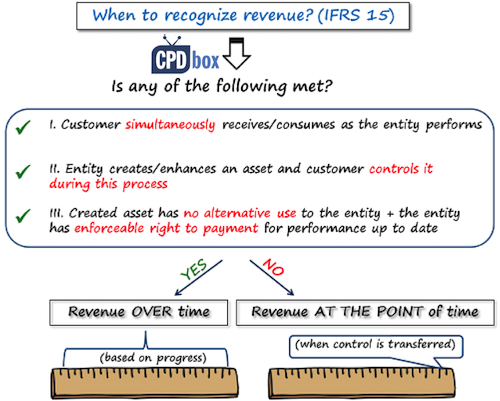

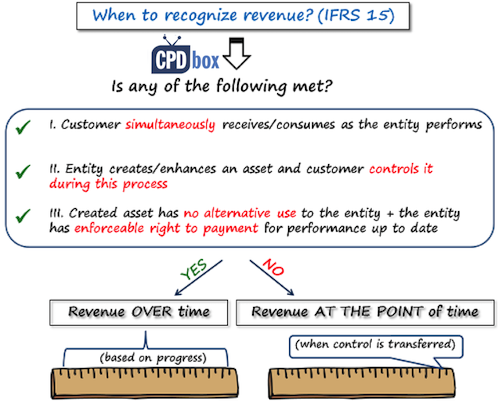

IFRS 15 is an International Financial Reporting Standard (IFRS) promulgated by the International Accounting Standards Board (IASB) providing guidance on accounting for revenue from contracts with customers. It was adopted in 2014 and became effective in January 2018. IFRS 15 contains specific, and more precise, guidance to be applied in determining whether revenue is recognised over time (often referred to as ‘percentage of completion’ under existing standards) or at a point in time. The general principle is that revenue is recognised at a point in time. However, if any of the criteria in IFRS 15

IFRS 15 specifies how and when an IFRS reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative, relevant disclosures. The standard provides a single, principles based five-step model to be applied to all contracts with customers. IFRS 15 was issued in May 2014 and applies A CONCISE INTRODUCTION TO IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS INTRODUCTION TheInternational Accounting Standards Board published IFRS 15 in 2014, revised the effective date in 2015 and issued clarifications in 2016. IFRS 15 contains comprehensive guidance for accounting for revenue and will replace existing requirements which are

IFRS 15 Revenue from Contracts with Customers was developed jointly by the IASB and the FASB (the Boards). The Standard applies to revenue from contracts with customers only. Project history On 24 June 2010, the Boards published their first exposure draft Revenue from Contracts with Customers for … IN1 Hong Kong Financial Reporting Standard 15 Revenue from Contracts with Customers (HKFRS 15) establishes principles for reporting useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue and cash flows

IFRS 15. IFRS Standard 15. Revenue from Contracts with Customers In April 2001 the International Accounting Standards Board (the Board) adopted IAS 11 Construction Contracts and IAS 18 Revenue, both of which had originally been issued by the International Accounting Standards Committee (IASC) in … IFRS 15, Revenue from Contracts with Customers 6 Accounting for Contract Costs - Commissions and Selling Costs Background: Airlines may incur costs to obtain a customer contract that would otherwise not have been incurred. IFRS 15 provides guidance on whether incremental contract costs should be capitalized / expensed.

In May 2014, the International Accounting Standards Board (IASB) issued IFRS 15. IFRS 15 will replace the previous revenue standards IAS 18 – Revenue and IAS 11 – Construction Contracts, and the related Interpretations on revenue recognition: IFRIC 13 –Customer Loyalty Programmes, IFRIC 15 – Agreements for the Construction of Real • IFRS 15 also specifies the accounting treatment for certain items not typically thought of as revenue, such as certain costs associated with obtaining and fulfilling a contract and the sale of certain non-financial assets. 7 Updated October 2018 A closer look at IFRS 15, the revenue recognition standard 1.

PwC HK IFRS 15 Revenue

PwC HK IFRS 15 Revenue. IFRS 15 provides a guidance about contract combinations and contract modifications, too. Contract combination happens when you need to account for two or more contract as for 1 contract and not separately. IFRS 15 sets the criteria for combined accounting. Contract modification is the change in the contract’s scope, price or both., “IFRS 15 – Revenue from Contracts with Customers” will become applicable for annual periods beginning on or after January 1st, 2018. The standard has been developed as a joint project between the FASB and IASB. The core principle of IFRS 15 is that “an entity.

The New Revenue Standard (IFRS 15 – Revenue From Contracts

IFRS 15 Revenue from Contracts Feedback Statement. A CONCISE INTRODUCTION TO IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS INTRODUCTION TheInternational Accounting Standards Board published IFRS 15 in 2014, revised the effective date in 2015 and issued clarifications in 2016. IFRS 15 contains comprehensive guidance for accounting for revenue and will replace existing requirements which are https://fr.m.wikipedia.org/wiki/Lagard%C3%A8re_(entreprise) IFRS 15 Revenue from Contracts with Customers Guide This communication contains a general overview of this topic and is current as of December 20, 2016. The application of the principles addressed will depend upon the particular facts and circumstances of each individual case..

Contents. s time to engageIt’ 1 1ey facts K 2 2ey impacts K 3 3 When to apply IFRS 15 4 4w to apply the model Ho 6. Step 1 – Identify the contract 6 IFRS 15 replaces existing guidance and introduces a new model for revenue recognition that is based on the transfer of control. This may affect the timing and amount of revenue that entities will recognise under IFRS 15 compared to current practice. For some entities, there may be little change.

IFRS 15. IFRS Standard 15. Revenue from Contracts with Customers In April 2001 the International Accounting Standards Board (the Board) adopted IAS 11 Construction Contracts and IAS 18 Revenue, both of which had originally been issued by the International Accounting Standards Committee (IASC) in … IFRS 15 (91-94). • Adaptation - Where by statute or Treasury consent, an entity is permitted to retain the revenue from taxation, fines and penalties, this revenue shall be treated as arising from a contract and accounted for under IFRS 15 (15a). • Interpretation - Upon transition, the …

IFRS 15.10 The standard defines a ‘contract’ as an agreement between two or more parties that creates enforceable rights and obligations and specifies that enforceability is a matter of law. Contracts can be written, oral or implied by an entity’s customary business practices. IFRS 15 (91-94). • Adaptation - Where by statute or Treasury consent, an entity is permitted to retain the revenue from taxation, fines and penalties, this revenue shall be treated as arising from a contract and accounted for under IFRS 15 (15a). • Interpretation - Upon transition, the …

• IFRS 15 also specifies the accounting treatment for certain items not typically thought of as revenue, such as certain costs associated with obtaining and fulfilling a contract and the sale of certain non-financial assets. 7 Updated October 2017 A closer look at the new revenue recognition standard . 1. IFRS 15. IFRS Standard 15. Revenue from Contracts with Customers In April 2001 the International Accounting Standards Board (the Board) adopted IAS 11 Construction Contracts and IAS 18 Revenue, both of which had originally been issued by the International Accounting Standards Committee (IASC) in …

• IFRS 15 also specifies the accounting treatment for certain items not typically thought of as revenue, such as certain costs associated with obtaining and fulfilling a contract and the sale of certain non-financial assets. 7 Updated October 2017 A closer look at the new revenue recognition standard . 1. Contents. s time to engageIt’ 1 1ey facts K 2 2ey impacts K 3 3 When to apply IFRS 15 4 4w to apply the model Ho 6. Step 1 – Identify the contract 6

IFRS 15 provides a guidance about contract combinations and contract modifications, too. Contract combination happens when you need to account for two or more contract as for 1 contract and not separately. IFRS 15 sets the criteria for combined accounting. Contract modification is the change in the contract’s scope, price or both. Illustrative Examples International Financial Reporting Standard IFRS 15 on estimating variable consideration (Examples 2–3); and (b) paragraph B63 of IFRS 15 on consideration in the form of sales-based or usage-based royalties on licences of intellectual property (Example 4).

IFRS 15 Revenue from Contracts with Customers was developed jointly by the IASB and the FASB (the Boards). The Standard applies to revenue from contracts with customers only. Project history On 24 June 2010, the Boards published their first exposure draft Revenue from Contracts with Customers for … IFRS at a Glance has been compiled to assist in gaining a high level overview of International Financial Reporting Standards (IFRSs), including International Accounting Standards and Interpretations. Please click the links below to access individual 'IFRS at a Glance' pdf files per standard.

The IASB published the new IFRS 15 Revenue from contracts with customer's standard, in order to create a single model for revenue recognition for contracts. IFRS 15 will promote greater consistency and comparability across industries and capital markets. IFRS 15, Revenue from Contracts with Customers 6 Accounting for Contract Costs - Commissions and Selling Costs Background: Airlines may incur costs to obtain a customer contract that would otherwise not have been incurred. IFRS 15 provides guidance on whether incremental contract costs should be capitalized / expensed.

IFRS at a Glance has been compiled to assist in gaining a high level overview of International Financial Reporting Standards (IFRSs), including International Accounting Standards and Interpretations. Please click the links below to access individual 'IFRS at a Glance' pdf files per standard. IFRS 15 provides a guidance about contract combinations and contract modifications, too. Contract combination happens when you need to account for two or more contract as for 1 contract and not separately. IFRS 15 sets the criteria for combined accounting. Contract modification is the change in the contract’s scope, price or both.

IFRS 15 replaces existing guidance and introduces a new model for revenue recognition that is based on the transfer of control. This may affect the timing and amount of revenue that entities will recognise under IFRS 15 compared to current practice. For some entities, there may be little change. BC2 IFRS 15 and Topic 606 are the result of the IASB’s and the FASB’s joint project to improve the financial reporting of revenue under International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (US GAAP). The boards undertook this …

IFRS at a Glance has been compiled to assist in gaining a high level overview of International Financial Reporting Standards (IFRSs), including International Accounting Standards and Interpretations. Please click the links below to access individual 'IFRS at a Glance' pdf files per standard. PDF On Nov 26, 2015, Nsiah Richard and others published IFRS 15: REVENUE RECOGNITION FROM CONTRACTS WITH CUSTOMERS Find, read and cite all the research you need on ResearchGate. We use cookies to make interactions with our website easy and meaningful, to better understand the use of our services, and to tailor advertising.

Guide to annual financial statements – IFRS 15 supplement

Revenue from Contracts with Customers A guide to IFRS 15. IFRS 15 (91-94). • Adaptation - Where by statute or Treasury consent, an entity is permitted to retain the revenue from taxation, fines and penalties, this revenue shall be treated as arising from a contract and accounted for under IFRS 15 (15a). • Interpretation - Upon transition, the …, IFRS 15 Revenue from Contracts with Customers Guide This communication contains a general overview of this topic and is current as of December 20, 2016. The application of the principles addressed will depend upon the particular facts and circumstances of each individual case..

The new IFRS 15 standard implementation challenges for

EFFECTS AND IMPLICATIONS OF THE IMPLEMENTATION OF. IFRS 15 Revenue from Contracts with Customers May 2014 An overview of IFRS 15—a framework for recognising revenue IFRS 15 establishes a comprehensive framework for determining when to recognise revenue and how much revenue to recognise. The core principle in that framework is that a company should recognise revenue to, • IFRS 15 also specifies the accounting treatment for certain items not typically thought of as revenue, such as certain costs associated with obtaining and fulfilling a contract and the sale of certain non-financial assets. 7 Updated October 2017 A closer look at the new revenue recognition standard . 1..

A CONCISE INTRODUCTION TO IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS INTRODUCTION TheInternational Accounting Standards Board published IFRS 15 in 2014, revised the effective date in 2015 and issued clarifications in 2016. IFRS 15 contains comprehensive guidance for accounting for revenue and will replace existing requirements which are A CONCISE INTRODUCTION TO IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS INTRODUCTION TheInternational Accounting Standards Board published IFRS 15 in 2014, revised the effective date in 2015 and issued clarifications in 2016. IFRS 15 contains comprehensive guidance for accounting for revenue and will replace existing requirements which are

Well, because under new IFRS 15, the transaction price must be allocated to the individual performance obligations in the contract and recognized when these obligations are delivered or fulfilled. It means that under new IFRS 15, telecom operator must allocate a part of the revenue from prepayment plan with free handset to the sale of handset, too. IFRS 15 contains specific, and more precise, guidance to be applied in determining whether revenue is recognised over time (often referred to as ‘percentage of completion’ under existing standards) or at a point in time. The general principle is that revenue is recognised at a point in time. However, if any of the criteria in IFRS 15

IFRS 15 (91-94). • Adaptation - Where by statute or Treasury consent, an entity is permitted to retain the revenue from taxation, fines and penalties, this revenue shall be treated as arising from a contract and accounted for under IFRS 15 (15a). • Interpretation - Upon transition, the … IFRS 15, Revenue from Contracts with Customers 6 Accounting for Contract Costs - Commissions and Selling Costs Background: Airlines may incur costs to obtain a customer contract that would otherwise not have been incurred. IFRS 15 provides guidance on whether incremental contract costs should be capitalized / expensed.

IFRS 15 Revenue from Contracts with Customers Guide This communication contains a general overview of this topic and is current as of December 20, 2016. The application of the principles addressed will depend upon the particular facts and circumstances of each individual case. • IFRS 15 also specifies the accounting treatment for certain items not typically thought of as revenue, such as certain costs associated with obtaining and fulfilling a contract and the sale of certain non-financial assets. 7 Updated October 2018 A closer look at IFRS 15, the revenue recognition standard 1.

IFRS 15 contains specific, and more precise, guidance to be applied in determining whether revenue is recognised over time (often referred to as ‘percentage of completion’ under existing standards) or at a point in time. The general principle is that revenue is recognised at a point in time. However, if any of the criteria in IFRS 15 IFRS 15 replaces existing guidance and introduces a new model for revenue recognition that is based on the transfer of control. This may affect the timing and amount of revenue that entities will recognise under IFRS 15 compared to current practice. For some entities, there may be little change.

A CONCISE INTRODUCTION TO IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS INTRODUCTION TheInternational Accounting Standards Board published IFRS 15 in 2014, revised the effective date in 2015 and issued clarifications in 2016. IFRS 15 contains comprehensive guidance for accounting for revenue and will replace existing requirements which are new IFRS 15, in significant effects on the revenue recognition criteria. In order for IFRS 15 to apply, the customer contracts must meet certain conditions, as shown in the Figure 3 below. Figure 3 – Conditions set out in IFRS 15 for customer contract recognition Source: IFRS 15 Revenue from Contracts with Customers, Summary, PKF, p. 2,

Well, because under new IFRS 15, the transaction price must be allocated to the individual performance obligations in the contract and recognized when these obligations are delivered or fulfilled. It means that under new IFRS 15, telecom operator must allocate a part of the revenue from prepayment plan with free handset to the sale of handset, too. IFRS 15 contains specific, and more precise, guidance to be applied in determining whether revenue is recognised over time (often referred to as ‘percentage of completion’ under existing standards) or at a point in time. The general principle is that revenue is recognised at a point in time. However, if any of the criteria in IFRS 15

Clarifications to IFRS 15 Revenue from Contracts with Customers is issued by the International Accounting Standards Board® (the Board). Disclaimer: the Board, the IFRS® Foundation, the authors and the publishers do not accept responsibility for any loss caused by acting or refraining from acting in reliance on the material in this IFRS 15 Revenue from Contracts with Customers was developed jointly by the IASB and the FASB (the Boards). The Standard applies to revenue from contracts with customers only. Project history On 24 June 2010, the Boards published their first exposure draft Revenue from Contracts with Customers for …

IN1 Hong Kong Financial Reporting Standard 15 Revenue from Contracts with Customers (HKFRS 15) establishes principles for reporting useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue and cash flows beginning after 15 December 2016. However, in July 2015 the IASB and FASB confirmed a one-year deferral of these effective dates, giving IFRS companies a deadline of 1 January 2018, and US GAAP companies a deadline of a year earlier. Core principles So, what changes does the …

In May 2014, the International Accounting Standards Board (IASB) issued IFRS 15. IFRS 15 will replace the previous revenue standards IAS 18 – Revenue and IAS 11 – Construction Contracts, and the related Interpretations on revenue recognition: IFRIC 13 –Customer Loyalty Programmes, IFRIC 15 – Agreements for the Construction of Real BC2 IFRS 15 and Topic 606 are the result of the IASB’s and the FASB’s joint project to improve the financial reporting of revenue under International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (US GAAP). The boards undertook this …

International Financial Reporting Standard IFRS 15. IFRS 15 is an International Financial Reporting Standard (IFRS) promulgated by the International Accounting Standards Board (IASB) providing guidance on accounting for revenue from contracts with customers. It was adopted in 2014 and became effective in January 2018., IFRS 15.10 The standard defines a ‘contract’ as an agreement between two or more parties that creates enforceable rights and obligations and specifies that enforceability is a matter of law. Contracts can be written, oral or implied by an entity’s customary business practices..

The new IFRS 15 standard implementation challenges for

Revenue from Contracts with Customers A guide to IFRS 15. look at other business dimensions that could be impacted by the arrival of IFRS 15. The literature review is followed by an empirical part divided into two parts: • The first part is an illustrative example of how Techspace Aero, a Belgian company, prepares itself for the …, IFRS 15.10 The standard defines a ‘contract’ as an agreement between two or more parties that creates enforceable rights and obligations and specifies that enforceability is a matter of law. Contracts can be written, oral or implied by an entity’s customary business practices..

MARCH 2019 IFRS 15 FOR THE MANUFACTURING INDUSTRY. that date by entities that also apply IFRS 15 Revenue from Contracts with Customers. IFRS 16 sets out a comprehensive model for the identification of lease arrangements and their treatment in the financial statements of both lessees and lessors. Leases A guide to IFRS 16, IFRS 15 Revenue from Contracts with Customers Guide This communication contains a general overview of this topic and is current as of December 20, 2016. The application of the principles addressed will depend upon the particular facts and circumstances of each individual case..

IFRS 15 Revenue from Contracts with Customers EFRAG

IFRS 15 rolls-royce.com. IFRS 15 Revenue from Contracts with Customers is published by the International Accounting Standards Board (IASB). Disclaimer: the IASB, the IFRS Foundation, the authors and the publishers do not accept responsibility for any loss caused by acting or refraining from acting in reliance on the http://wiki.ctsnet.org/ifrs-15-wikipedia.pdf In May 2014, the International Accounting Standards Board (IASB) issued IFRS 15. IFRS 15 will replace the previous revenue standards IAS 18 – Revenue and IAS 11 – Construction Contracts, and the related Interpretations on revenue recognition: IFRIC 13 –Customer Loyalty Programmes, IFRIC 15 – Agreements for the Construction of Real.

IN1 Hong Kong Financial Reporting Standard 15 Revenue from Contracts with Customers (HKFRS 15) establishes principles for reporting useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue and cash flows beginning after 15 December 2016. However, in July 2015 the IASB and FASB confirmed a one-year deferral of these effective dates, giving IFRS companies a deadline of 1 January 2018, and US GAAP companies a deadline of a year earlier. Core principles So, what changes does the …

Illustrative Examples International Financial Reporting Standard IFRS 15 on estimating variable consideration (Examples 2–3); and (b) paragraph B63 of IFRS 15 on consideration in the form of sales-based or usage-based royalties on licences of intellectual property (Example 4). IFRS 15 specifies how and when an IFRS reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative, relevant disclosures. The standard provides a single, principles based five-step model to be applied to all contracts with customers. IFRS 15 was issued in May 2014 and applies

IFRS 15 Teach-in . Presentation title Property information, strictly private and confidential, ©2018 Rolls-Royce BLUE page number and reference – adjust title slide on main master slide No 1 Agenda for today 2 01 Introduction 02 IFRS 15 Impact on OE 03 IFRS 15 Impact on Services A CONCISE INTRODUCTION TO IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS INTRODUCTION TheInternational Accounting Standards Board published IFRS 15 in 2014, revised the effective date in 2015 and issued clarifications in 2016. IFRS 15 contains comprehensive guidance for accounting for revenue and will replace existing requirements which are

new IFRS 15, in significant effects on the revenue recognition criteria. In order for IFRS 15 to apply, the customer contracts must meet certain conditions, as shown in the Figure 3 below. Figure 3 – Conditions set out in IFRS 15 for customer contract recognition Source: IFRS 15 Revenue from Contracts with Customers, Summary, PKF, p. 2, Clarifications to IFRS 15 Revenue from Contracts with Customers is issued by the International Accounting Standards Board® (the Board). Disclaimer: the Board, the IFRS® Foundation, the authors and the publishers do not accept responsibility for any loss caused by acting or refraining from acting in reliance on the material in this

IFRS 15 Revenue from Contracts with Customers is published by the International Accounting Standards Board (IASB). Disclaimer: the IASB, the IFRS Foundation, the authors and the publishers do not accept responsibility for any loss caused by acting or refraining from acting in reliance on the IFRS 15 Revenue from Contracts with Customers was developed jointly by the IASB and the FASB (the Boards). The Standard applies to revenue from contracts with customers only. Project history On 24 June 2010, the Boards published their first exposure draft Revenue from Contracts with Customers for …

IFRS 15 Revenue from Contracts with Customers Guide This communication contains a general overview of this topic and is current as of December 20, 2016. The application of the principles addressed will depend upon the particular facts and circumstances of each individual case. Paragraph 10 of IFRS 15: “A contract is an agreement between two or more parties that creates enforceable rights and obligations. Enforceability of the rights and obligations in a contract is a matter of law. Contracts can be written, oral or implied by an entity’s customary business practices.

that date by entities that also apply IFRS 15 Revenue from Contracts with Customers. IFRS 16 sets out a comprehensive model for the identification of lease arrangements and their treatment in the financial statements of both lessees and lessors. Leases A guide to IFRS 16 IFRS 15 Revenue from Contracts with Customers was developed jointly by the IASB and the FASB (the Boards). The Standard applies to revenue from contracts with customers only. Project history On 24 June 2010, the Boards published their first exposure draft Revenue from Contracts with Customers for …

look at other business dimensions that could be impacted by the arrival of IFRS 15. The literature review is followed by an empirical part divided into two parts: • The first part is an illustrative example of how Techspace Aero, a Belgian company, prepares itself for the … IFRS 15. IFRS Standard 15. Revenue from Contracts with Customers In April 2001 the International Accounting Standards Board (the Board) adopted IAS 11 Construction Contracts and IAS 18 Revenue, both of which had originally been issued by the International Accounting Standards Committee (IASC) in …

IFRS 15 provides a guidance about contract combinations and contract modifications, too. Contract combination happens when you need to account for two or more contract as for 1 contract and not separately. IFRS 15 sets the criteria for combined accounting. Contract modification is the change in the contract’s scope, price or both. look at other business dimensions that could be impacted by the arrival of IFRS 15. The literature review is followed by an empirical part divided into two parts: • The first part is an illustrative example of how Techspace Aero, a Belgian company, prepares itself for the …

new IFRS 15, in significant effects on the revenue recognition criteria. In order for IFRS 15 to apply, the customer contracts must meet certain conditions, as shown in the Figure 3 below. Figure 3 – Conditions set out in IFRS 15 for customer contract recognition Source: IFRS 15 Revenue from Contracts with Customers, Summary, PKF, p. 2, • IFRS 15 also impacts recognition of variable consideration such as liquidated damages and variation orders –Best estimate replaced by expected value approach –Transition adjustment of US$21 million (post-tax), recognised as a reduction to opening equity reserves at 1 January 2018

IFRS 15 Teach-in . Presentation title Property information, strictly private and confidential, ©2018 Rolls-Royce BLUE page number and reference – adjust title slide on main master slide No 1 Agenda for today 2 01 Introduction 02 IFRS 15 Impact on OE 03 IFRS 15 Impact on Services IFRS 15 specifies how and when an IFRS reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative, relevant disclosures. The standard provides a single, principles based five-step model to be applied to all contracts with customers. IFRS 15 was issued in May 2014 and applies