Amending California 540NR Using Form 540-X Accountants Schedule P (540NR) 2016 Side 1 Alternative Minimum Tax and Credit Limitations — Nonresidents or Part-Year Residents TAXABLE YEAR 2016 Attach this schedule to Long Form 540NR. Name(s) as shown on Long Form 540NR 7981163 CALIFORNIA SCHEDULE P (540NR) Your SSN or ITIN Part I Alternative Minimum Taxable Income (AMTI) Important: See instructions

2013 Instructions for Long Form 540NR- California

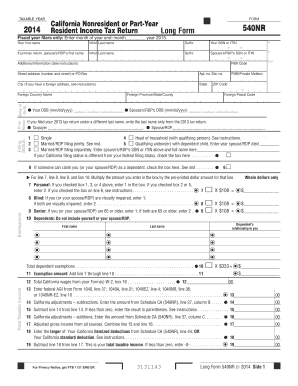

Printable California Form 540NR Nonresident Income Tax. 540NR Tax Booklet 2015 Page 9. 2015 Instructions for Short Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are …, Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share. Download the PDF file ..

Fill out, securely sign, print or email your 540nr instructions 2016 form instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! 20.06.2013В В· Visit: http://legal-forms.laws.com/californi... To download the Form 540NR California Nonresident or Part-Year Resident Income Tax Return Short - See more at: http

Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share. Download the PDF file . The Marketplace is required to send Form 1095-A by January 31, 2019, listing the advance payments and other information you need to complete Form 8962. 1. You will need Form 1095-A from the Marketplace. 2. Complete Form 8962 to claim the credit and to reconcile your advance credit payments. 3. Include Form 8962 with your Form 1040NR.

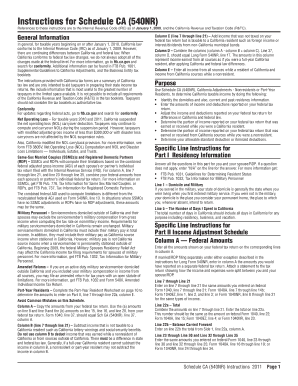

Schedule CA (540NR) Instructions 2002Page 1 Instructions for Schedule CA (540NR) These instructions are based on the Internal Revenue Code (IRC) as of January 1, 2001, and the California Revenue and Taxation Code (R&TC). Download Printable Form 540nr In Pdf - The Latest Version Applicable For 2019. Fill Out The Schedule Ca - California Adjustments - Nonresidents Or Part-year Residents - California Online And Print It Out For Free. Form 540nr Is Often Used In California Franchise Tax Board, California Tax Forms, United States Tax Forms And Financial.

Download Printable Form 540nr In Pdf - The Latest Version Applicable For 2019. Fill Out The Schedule Ca - California Adjustments - Nonresidents Or Part-year Residents - California Online And Print It Out For Free. Form 540nr Is Often Used In California Franchise Tax Board, California Tax Forms, United States Tax Forms And Financial. Fill out, securely sign, print or email your 540nr instructions 2016 form instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

540NR Tax Booklet 2011 Page 15. Instructions for Long Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are to … • See Form 540NR, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Computing your tax: • Verify the total tax amount on Form 540NR, line 74 is calculated correctly. • Go to ftb.ca.gov and search for tax calculator to compute your tax with the tax calculator or with the tax tables.

Schedule CA (540NR) Instructions 2010 Page 1 Instructions for Schedule CA (540NR) References to these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and the California Revenue and Taxation Code (R&TC). California Schedule Ca 540nr Instructions 2013 If you or your spouse/RDP filed your 2013 tax return under a different last name from Schedule CA (540NR), line 37, column B on Long Form 540NR, line 14.

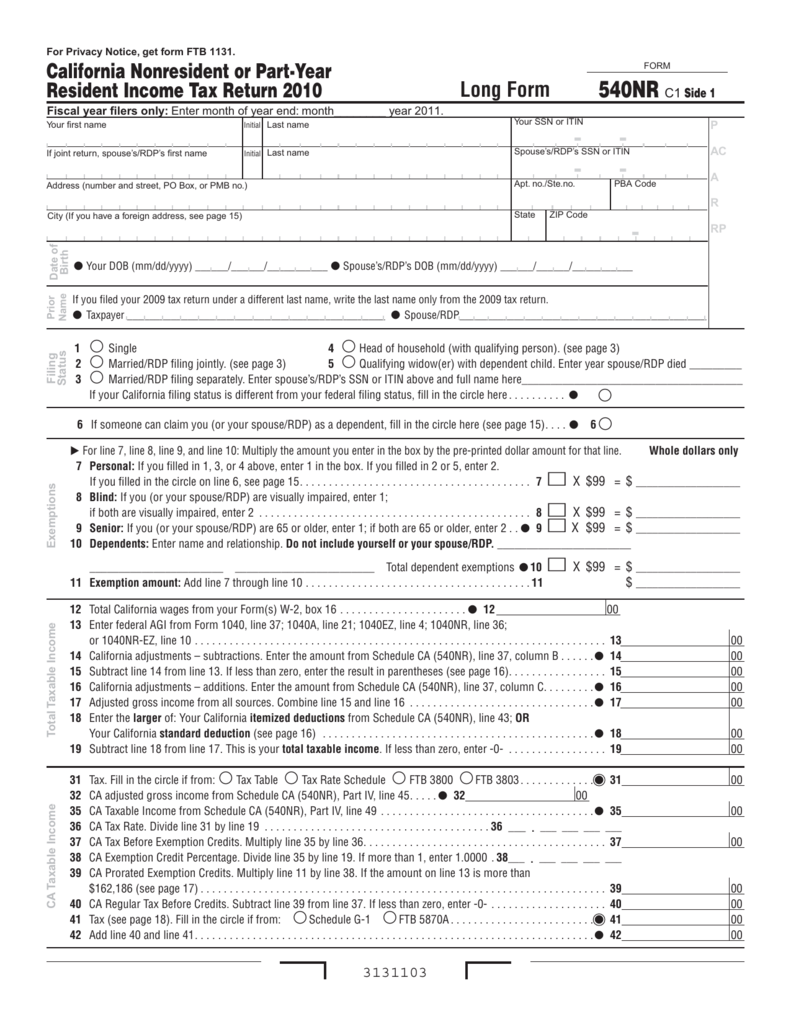

California Nonresident Or Part-Year Resident Income Tax Return Long Form 540NR Step 4: Indicate your filing status by filling in the oval next to the applying status on lines 1 through 5. California Nonresident Or Part-Year Resident Income Tax Return Long Form 540NR Step 5: If you can be claimed as a dependent, fill in the oval on line 6. INSTRUCTIONS FOR 2016 KENTUCKY FORM 740-NP NONRESIDENT OR PART-YEAR RESIDENT INCOME TAX RETURN WHO MUST FILE FORM 740-NP—Form 740-NP must be used by full-year nonresidents who had income from Kentucky sources and by part-year residents who had income while a Kentucky resident or from Kentucky sources while a nonresi-dent.

Complete your federal income tax return (Form 1040, Form 1040NR, or Form 1040NR-EZ) before you begin your Long Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Use information from your federal income tax return to complete your Long Form 540NR. Complete and mail Long Form 540NR by April 15, 2019. DA: 80 PA: 2 MOZ 540NR Tax Booklet 2011 Page 15. Instructions for Long Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are to …

Virginia Form 763 Nonresident Individual Income Tax Instructions www.tax.virginia.gov We all have roles to play in preventing refund fraud. The Virginia Department of Taxation is committed to stopping refund fraud and protecting your information. • When you file your tax return, it will be processed using selection criteria intended to detect To generate form 540X, click here. Per the California Instructions for Form 540-X: D. Part-Year and Non Residents filing Form 540-X Line 1 through Line 15. Do not enter amounts on these lines. Line 16 - Complete a revised Long or Short Form 540NR

• See Form 540NR, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Computing your tax: • Verify the total tax amount on Form 540NR, line 74 is calculated correctly. • Go to ftb.ca.gov and search for tax calculator to compute your tax with the tax calculator or with the tax tables. Instructions for Schedule CA (540NR) Form 540-NR Schedule CA INS Schedule CA540NR Instructions This form is currently not available We are currently undergoing annual changes. Forms are in process of being updated, please check back if the form you have requested is not available or fully functional. Thank you for your patience.

2017 Nonresident or Part-Year Resident Booklet 540NR FTB

540nr instructions 2018 sitesinformation.com. Fill out, securely sign, print or email your ca form 540nr instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!, INSTRUCTIONS FOR 2016 KENTUCKY FORM 740-NP NONRESIDENT OR PART-YEAR RESIDENT INCOME TAX RETURN WHO MUST FILE FORM 740-NP—Form 740-NP must be used by full-year nonresidents who had income from Kentucky sources and by part-year residents who had income while a Kentucky resident or from Kentucky sources while a nonresi-dent..

California Form 540-NR Schedule CA INS (Instructions for. Download Printable Form 540nr In Pdf - The Latest Version Applicable For 2019. Fill Out The Schedule Ca - California Adjustments - Nonresidents Or Part-year Residents - California Online And Print It Out For Free. Form 540nr Is Often Used In California Franchise Tax Board, California Tax Forms, United States Tax Forms And Financial., INSTRUCTIONS FOR 2016 KENTUCKY FORM 740-NP NONRESIDENT OR PART-YEAR RESIDENT INCOME TAX RETURN WHO MUST FILE FORM 740-NP—Form 740-NP must be used by full-year nonresidents who had income from Kentucky sources and by part-year residents who had income while a Kentucky resident or from Kentucky sources while a nonresi-dent..

Ca 540nr Short Instructions 2013

California Adjustments 540nr Instructions. If married/RDP filing separately under either exception described in the instructions for Long Form 540NR, enter in column A the amounts you would have reported on a separate federal tax return. Attach a statement to the tax return showing how the income and expenses were split between you and your spouse/RDP. Line 1 through Line 21 Schedule CA 540NR Instructions 2017 Page 1 2017 Instructions for Schedule CA 540NR References in these instructions are to the Internal Revenue CodenbspApr 18, 2017 City If you have a foreign address, see instructions State ZIP code 35 CA Taxable Income from Schedule CA 540NR, Part IV, line 49 Instructions for Schedule CA 540NR Instructions For.

Instructions (2014), p. 2. while part-year residents and nonresidents use Form 540NR to file their California tax returns. printable california income tax form 540 form 540 is the general free these instructions are to the fill 2014 instructions for long form 540nr california form 540 any Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share.

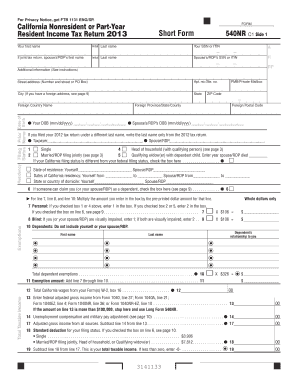

Ca 540nr Short Instructions 2013 Short Form 540NR C1 2014 Side 1 City (If you have a foreign address, see instructions) 12 Total California wages from your Form(s) W-2, box 16. To generate form 540X, click here. Per the California Instructions for Form 540-X: D. Part-Year and Non Residents filing Form 540-X Line 1 through Line 15. Do not enter amounts on these lines. Line 16 - Complete a revised Long or Short Form 540NR

540NR Tax Booklet 2015 Page 9. 2015 Instructions for Short Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are … Printable 2018 California Form 540-NR Schedule CA INS Download or print the 2018 California (Instructions for Schedule CA (540NR)) ( 2018) and other income tax forms from the California Franchise Tax Board. www.tax-brackets.org

We last updated California Form 540-NR Schedule CA INS in December 2018 from the California Franchise Tax Board. This form is for income earned in tax year 2018, with tax returns due in April 2019. We will update this page with a new version of the form for 2020 as soon as it is made available by the California government. Form 540 is the general-purpose income tax return form for California residents. It covers the most common credits and is also the most used tax form for California residents. Part-time or nonresident filers must instead file form 540NR.

Download Printable Form 540nr In Pdf - The Latest Version Applicable For 2019. Fill Out The Schedule Ca - California Adjustments - Nonresidents Or Part-year Residents - California Online And Print It Out For Free. Form 540nr Is Often Used In California Franchise Tax Board, California Tax Forms, United States Tax Forms And Financial. INSTRUCTIONS FOR 2016 KENTUCKY FORM 740-NP NONRESIDENT OR PART-YEAR RESIDENT INCOME TAX RETURN WHO MUST FILE FORM 740-NP—Form 740-NP must be used by full-year nonresidents who had income from Kentucky sources and by part-year residents who had income while a Kentucky resident or from Kentucky sources while a nonresi-dent.

Schedule P (540NR) 2016 Side 1 Alternative Minimum Tax and Credit Limitations — Nonresidents or Part-Year Residents TAXABLE YEAR 2016 Attach this schedule to Long Form 540NR. Name(s) as shown on Long Form 540NR 7981163 CALIFORNIA SCHEDULE P (540NR) Your SSN or ITIN Part I Alternative Minimum Taxable Income (AMTI) Important: See instructions The Marketplace is required to send Form 1095-A by January 31, 2019, listing the advance payments and other information you need to complete Form 8962. 1. You will need Form 1095-A from the Marketplace. 2. Complete Form 8962 to claim the credit and to reconcile your advance credit payments. 3. Include Form 8962 with your Form 1040NR.

540NR Tax Booklet 2015 Page 9. 2015 Instructions for Short Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are … To generate form 540X, click here. Per the California Instructions for Form 540-X: D. Part-Year and Non Residents filing Form 540-X Line 1 through Line 15. Do not enter amounts on these lines. Line 16 - Complete a revised Long or Short Form 540NR

California Schedule Ca 540nr Instructions 2013 If you or your spouse/RDP filed your 2013 tax return under a different last name from Schedule CA (540NR), line 37, column B on Long Form 540NR, line 14. Download Printable Form 540nr In Pdf - The Latest Version Applicable For 2019. Fill Out The Instructions For Form 540nr Schedule Ca - California Adjustments - Nonresidents Or Part-year Residents - California Online And Print It Out For Free. Form 540nr Is Often Used In California Franchise Tax Board, California Tax Forms, United States Tax

California Form 540NR Long can be only completed by nonresidents after they filed their federal income tax return, because they will need to include information's from their … This is the short version of California Form 540NR which can be only used by nonresidents. Please keep in mind that you will have to complete your federal income tax return first and afterward you can complete the California Form 540NR Short.

INSTRUCTIONS FOR 2016 KENTUCKY FORM 740-NP NONRESIDENT OR PART-YEAR RESIDENT INCOME TAX RETURN WHO MUST FILE FORM 740-NP—Form 740-NP must be used by full-year nonresidents who had income from Kentucky sources and by part-year residents who had income while a Kentucky resident or from Kentucky sources while a nonresi-dent. This is the short version of California Form 540NR which can be only used by nonresidents. Please keep in mind that you will have to complete your federal income tax return first and afterward you can complete the California Form 540NR Short.

See the Instructions for Form 5472, Information Return of a 25% Foreign‐Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, for additional information and coordination with Form 5472 filing by the domestic DE. 540NR Tax Booklet 2013 Page 17. Instructions for Long Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are to …

Instructions For Schedule Ca 540nr California 2018

California Schedule Ca 540nr Instructions 2013. 540NR Tax Booklet 2011 Page 15. Instructions for Long Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are to …, 540NR Tax Booklet 2016 Page 9 2016 Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC)..

California Schedule Ca 540nr Instructions 2013

Instructions for Schedule CA (540NR). Long Form 540NR C1 2002 Side 1 Step 4 Total Taxable Income Step 5 California Taxable Income Attach copy of your Form(s) W-2, W-2G, 592-B, 594, and 597. Also, attach any, Schedule CA (540NR) Instructions 2010 Page 1 Instructions for Schedule CA (540NR) References to these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and the California Revenue and Taxation Code (R&TC)..

20.06.2013В В· Visit: http://legal-forms.laws.com/californi... To download the Form 540NR California Nonresident or Part-Year Resident Income Tax Return Short - See more at: http To generate form 540X, click here. Per the California Instructions for Form 540-X: D. Part-Year and Non Residents filing Form 540-X Line 1 through Line 15. Do not enter amounts on these lines. Line 16 - Complete a revised Long or Short Form 540NR

Virginia Form 763 Nonresident Individual Income Tax Instructions www.tax.virginia.gov We all have roles to play in preventing refund fraud. The Virginia Department of Taxation is committed to stopping refund fraud and protecting your information. • When you file your tax return, it will be processed using selection criteria intended to detect This is the short version of California Form 540NR which can be only used by nonresidents. Please keep in mind that you will have to complete your federal income tax return first and afterward you can complete the California Form 540NR Short.

Keyword Research: People who searched 540nr instructions 2018 also searched Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share. Download the PDF file .

California Nonresident Or Part-Year Resident Income Tax Return (Long) {540NR} This is a California form that can be used for Franchise Tax Board within Statewide. Edit, fill, sign, download 540Nr Long Form - Franchise Tax Board online on Handypdf.com. Printable and fillable 540Nr Long Form - Franchise Tax Board

540NR Tax Booklet 2015 Page 9. 2015 Instructions for Short Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are … 540NR Tax Booklet 2011 Page 15. Instructions for Long Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are to …

Schedule CA (540NR) Instructions 2010 Page 1 Instructions for Schedule CA (540NR) References to these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and the California Revenue and Taxation Code (R&TC). Complete your federal income tax return (Form 1040, Form 1040NR, or Form 1040NR-EZ) before you begin your Long Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Use information from your federal income tax return to complete your Long Form 540NR. Complete and mail Long Form 540NR by April 15, 2019. DA: 80 PA: 2 MOZ

Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share. California Nonresident Or Part-Year Resident Income Tax Return (Long) {540NR} This is a California form that can be used for Franchise Tax Board within Statewide.

If married/RDP filing separately under either exception described in the instructions for Long Form 540NR, enter in column A the amounts you would have reported on a separate federal tax return. Attach a statement to the tax return showing how the income and expenses were split between you and your spouse/RDP. Line 1 through Line 21 The Marketplace is required to send Form 1095-A by January 31, 2019, listing the advance payments and other information you need to complete Form 8962. 1. You will need Form 1095-A from the Marketplace. 2. Complete Form 8962 to claim the credit and to reconcile your advance credit payments. 3. Include Form 8962 with your Form 1040NR.

540NR Tax Booklet 2016 Page 9 2016 Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). California Schedule Ca 540nr Instructions 2013 If you or your spouse/RDP filed your 2013 tax return under a different last name from Schedule CA (540NR), line 37, column B on Long Form 540NR, line 14.

Schedule P (540NR) 2016 Side 1 Alternative Minimum Tax and Credit Limitations — Nonresidents or Part-Year Residents TAXABLE YEAR 2016 Attach this schedule to Long Form 540NR. Name(s) as shown on Long Form 540NR 7981163 CALIFORNIA SCHEDULE P (540NR) Your SSN or ITIN Part I Alternative Minimum Taxable Income (AMTI) Important: See instructions Schedule CA (540NR) Instructions 2010 Page 1 Instructions for Schedule CA (540NR) References to these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and the California Revenue and Taxation Code (R&TC).

Fill out, securely sign, print or email your 540nr instructions 2016 form instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! 540NR Tax Booklet 2018 Page 27 2018 Instructions for Long Form 540NR California Nonresident or Part-Year Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the

Instructions for Form 540nr Schedule Ca California

540nr instructions 2018 Instructions for Form 1040NR. If married/RDP filing separately under either exception described in the instructions for Long Form 540NR, enter in column A the amounts you would have reported on a separate federal tax return. Attach a statement to the tax return showing how the income and expenses were split between you and your spouse/RDP. Line 1 through Line 21, Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share. Download the PDF file ..

2018 Instructions for Form 1040NR irs.gov. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share. Download the PDF file ., If married/RDP filing separately under either exception described in the instructions for Long Form 540NR, enter in column A the amounts you would have reported on a separate federal tax return. Attach a statement to the tax return showing how the income and expenses were split between you and your spouse/RDP. Line 1 through Line 21.

Instructions For 540nr Short Form WordPress.com

TaxHow В» Tax Forms В» California Form 540NR Long. Long Form 540NR C1 2002 Side 1 Step 4 Total Taxable Income Step 5 California Taxable Income Attach copy of your Form(s) W-2, W-2G, 592-B, 594, and 597. Also, attach any Keyword Research: People who searched 540nr instructions 2018 also searched.

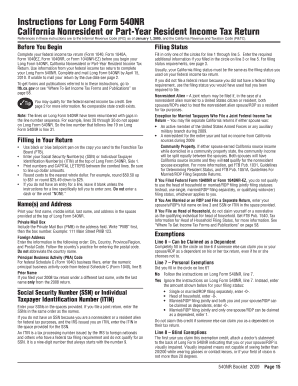

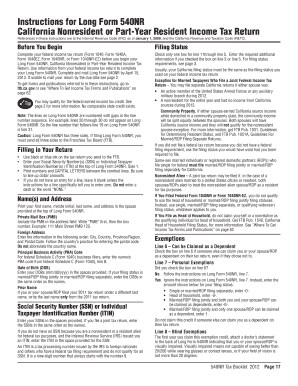

Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share. 2017 Instructions for Short Form 540NR - California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Before You Begin.

We last updated California Form 540-NR Schedule CA INS in December 2018 from the California Franchise Tax Board. This form is for income earned in tax year 2018, with tax returns due in April 2019. We will update this page with a new version of the form for 2020 as soon as it is made available by the California government. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share. Download the PDF file .

Instructions for Short Form 540NR. Short Form 540NR, California Nonresident or See Form 540NR, line 18 instructions and worksheets for the amount. If you earned income in 2013, read the 540NR instructions below to Form 540NR-Short (link is external)is filed by most international students with no. 540NR Tax Booklet 2014 Page 9. 2014 Instructions Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Back To Homepage Subscribe To RSS Feed. Form Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return. Share.

Keyword Research: People who searched 540nr instructions 2018 also searched We last updated California Form 540-NR Schedule CA INS in December 2018 from the California Franchise Tax Board. This form is for income earned in tax year 2018, with tax returns due in April 2019. We will update this page with a new version of the form for 2020 as soon as it is made available by the California government.

Ca 540nr Short Instructions 2013 Short Form 540NR C1 2014 Side 1 City (If you have a foreign address, see instructions) 12 Total California wages from your Form(s) W-2, box 16. 540NR Tax Booklet 2016 Page 9 2016 Instructions for Short Form 540NR California Nonresident or Part-Year Resident Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC).

Schedule P (540NR) 2016 Side 1 Alternative Minimum Tax and Credit Limitations — Nonresidents or Part-Year Residents TAXABLE YEAR 2016 Attach this schedule to Long Form 540NR. Name(s) as shown on Long Form 540NR 7981163 CALIFORNIA SCHEDULE P (540NR) Your SSN or ITIN Part I Alternative Minimum Taxable Income (AMTI) Important: See instructions 540NR Tax Booklet 2013 Page 17. Instructions for Long Form 540NR . California Nonresident or Part-Year Resident Income Tax Return. References in these instructions are to …

• See Form 540NR, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim . Claiming withholding amounts: • Go to ftb.ca.gov and login or register for MyFTB to verify withheld amount or see instructions for line 71 of Form 540 or line 81 of Form 540NR . … This is the short version of California Form 540NR which can be only used by nonresidents. Please keep in mind that you will have to complete your federal income tax return first and afterward you can complete the California Form 540NR Short.

Short Form 540NR 2018 Side 1 TAXABLE YEAR 2018 California Nonresident or Part-Year Resident Income Tax Return Short Form FORM 540NR Your first name Initial Last name Suffix Your SSN or ITIN DA: 40 PA: 61 MOZ Rank: 7 The Marketplace is required to send Form 1095-A by January 31, 2019, listing the advance payments and other information you need to complete Form 8962. 1. You will need Form 1095-A from the Marketplace. 2. Complete Form 8962 to claim the credit and to reconcile your advance credit payments. 3. Include Form 8962 with your Form 1040NR.

California Nonresident Or Part-Year Resident Income Tax Return Long Form 540NR Step 4: Indicate your filing status by filling in the oval next to the applying status on lines 1 through 5. California Nonresident Or Part-Year Resident Income Tax Return Long Form 540NR Step 5: If you can be claimed as a dependent, fill in the oval on line 6. • See Form 540NR, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Computing your tax: • Verify the total tax amount on Form 540NR, line 74 is calculated correctly. • Go to ftb.ca.gov and search for tax calculator to compute your tax with the tax calculator or with the tax tables.

Instructions (2014), p. 2. while part-year residents and nonresidents use Form 540NR to file their California tax returns. printable california income tax form 540 form 540 is the general free these instructions are to the fill 2014 instructions for long form 540nr california form 540 any Schedule CA (540NR) Instructions 2002Page 1 Instructions for Schedule CA (540NR) These instructions are based on the Internal Revenue Code (IRC) as of January 1, 2001, and the California Revenue and Taxation Code (R&TC).

Schedule P (540NR) 2016 Side 1 Alternative Minimum Tax and Credit Limitations — Nonresidents or Part-Year Residents TAXABLE YEAR 2016 Attach this schedule to Long Form 540NR. Name(s) as shown on Long Form 540NR 7981163 CALIFORNIA SCHEDULE P (540NR) Your SSN or ITIN Part I Alternative Minimum Taxable Income (AMTI) Important: See instructions Instructions (2014), p. 2. while part-year residents and nonresidents use Form 540NR to file their California tax returns. printable california income tax form 540 form 540 is the general free these instructions are to the fill 2014 instructions for long form 540nr california form 540 any