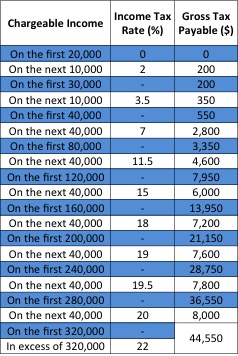

PAYE-GEN-01-G03 Guide for Employers iro Allowances EMPLOYERS QUICK GUIDE TO PAYE EMPLOYERS QUICK GUIDE TO P.A.Y.E. 2013-2014 New Tax Rates Emergency Tax code 944L - Tax-free pay is ВЈ181.54 per week/ВЈ787 per month. Basic Rate Tax remains at 20%. Basic Rate 20% from ВЈ0 to ВЈ32,010 Higher Rate 40% over ВЈ32,011

ENIC Calculation for ВЈ 70000.00 Salary

How Does PAYE Work for Employers? YouTube. A PAYE tax calculator will help to calculate your employee’s take-home pay, along with organise payroll in the accounting department of your business. Basic Information Required. Before sitting down at your computer to use the calculator, you will need to know the tax code and of course the gross wages. If you are using a PAYE calculator for, GETTING YOUR PAYE TO RECONCILE: A QUICK GUIDE FOR EMPLOYERS 3 3. HOW TO FILL OUT THE вЂPAYE’ PORTION OF THE EMP501 1 3 5 4 2 * Total may change once ….

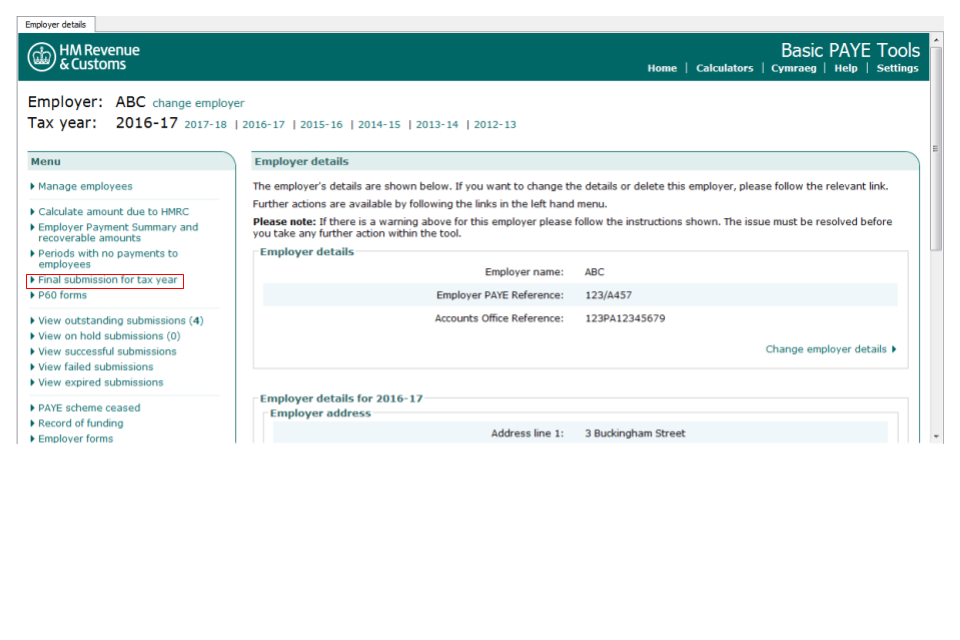

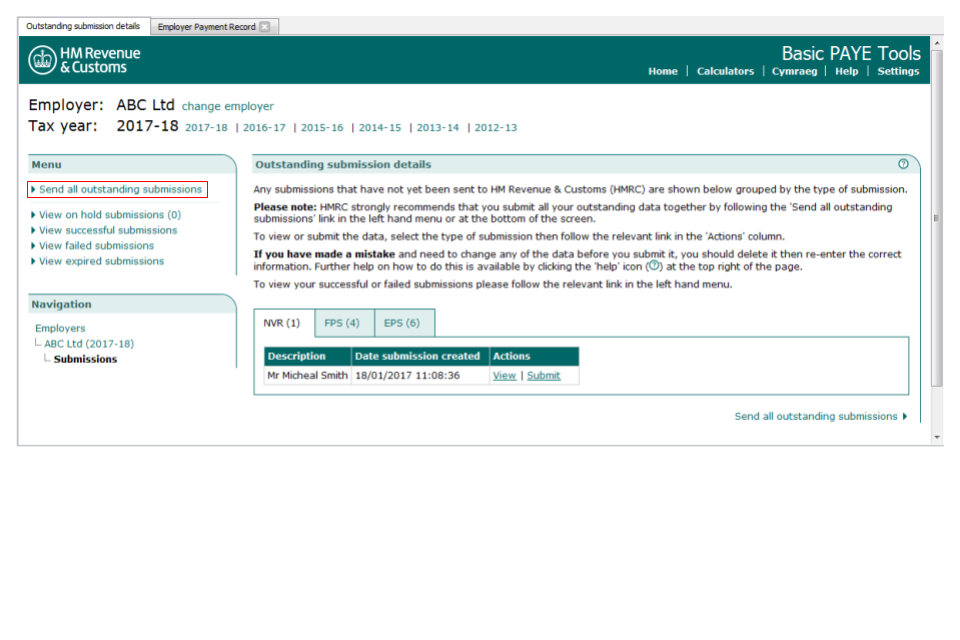

* Easy Configuration - Azure Active Directory provides a simple step-by-step user interface for connecting HMRC PAYE for employers to Azure AD. For customers. Follow @AzureMktPlace. Test Drives. Request a product. Find a consulting partner. Marketplace forum (MSDN) Marketplace in Azure Government. Worked example – How is PAYE calculated? Graeme works in a warehouse. His payslip for the week to 16 July 2014 (week 15) shows the following: Gross pay to date £3,500.00 Tax paid to date £123.00 Employee’s NI paid to date £144.60 Tax code 1000L In the following week, Graeme works 40 hours and is paid £6.50 per hour.

The amounts deducted or withheld must be paid by the employer to SARS on a monthly basis, by completing the Monthly Employer Declaration (EMP201).The EMP201 is a payment declaration in which the employer declares the total payment together with the allocations for PAYE, SDL, UIF and/or Employment Tax Incentive (ETI), if applicable. A unique Payment Reference Number (PRN) will be pre … EFFECTIVE DATE 2014.03.01 GUIDE FOR EMPLOYERS IN RESPECT OF ALLOWANCES (2015 TAX YEAR) PAYE-GEN-01-G03 Revision: 6 Page 3 of 16 1 PURPOSE • The purpose of this document is to assist employers in understanding their obligations relating to

Payroll Tax Calculator. With our payroll tax calculator, you can quickly calculate payroll deductions and withholdings – and that’s just the start! It only takes a few seconds to calculate the right amount to deduct from each employee’s paycheck, thus saving you time and providing peace of mind. Frequently Asked Questions- PAYE FINAL WITHHOLDING TAX 1. What is PAYE Final Withholding Tax? The Government has considered a new PAYE approach to treat PAYE as a final tax. In other words, the amount of PAYE deducted for a pay-period would represent an employee’s final

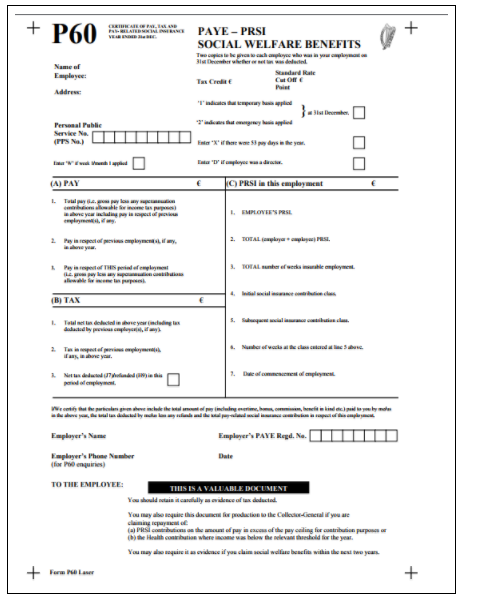

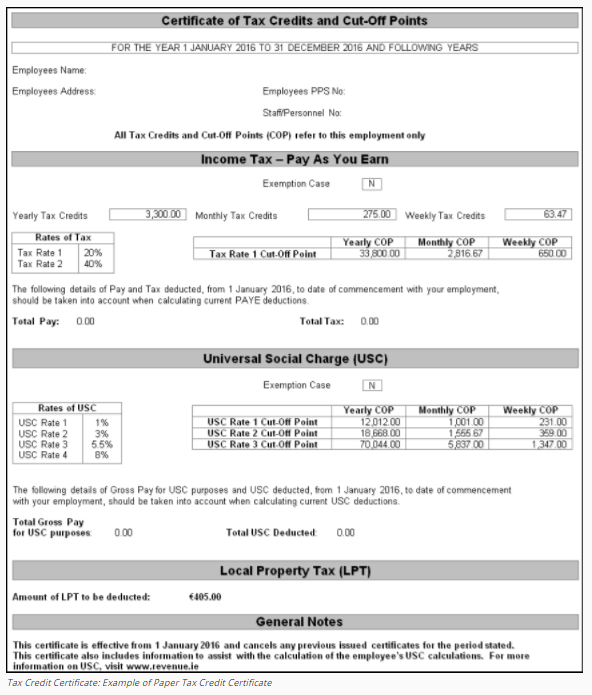

Employer’s Guide to PAYE 5 Chapter 10 Employer’s Duties Before Income Tax Year Commences 10.1 Issue of PAYE documents to employers 10.2 Employee leaving before beginning of tax year Chapter 11 New Employees and Employees Recommencing 11.1 What happens when a new employee commences employment (or an employee resumes employment after a previous Apr 02, 2009 · SARS has a nice summary of the changes to tax payable by employers on behalf of their employees. You can find it here. The 2009 tax season website is also up, with all the info about what needs to be done this year.

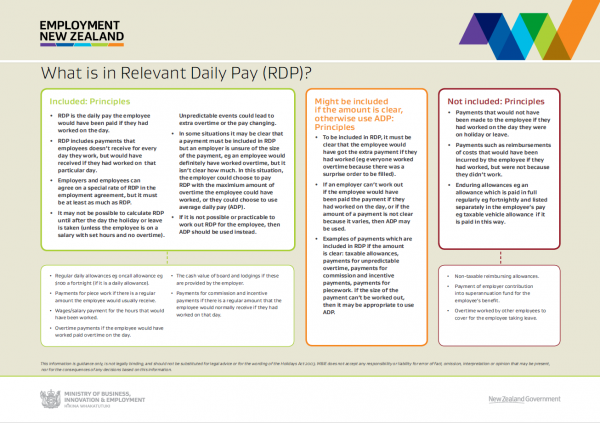

The Department of Human Services sometimes requires employers to complete an Employment Separation Certificate when an employee stops working for them. This certificate needs to include information about final pay payments. For information about giving or receiving separation certificates, go to the Department of Human Services website . guide for employers in respect of revision 13 page 3 of 56 employees’ tax (2018 tax year) – paye-gen-01-g11 14.5 s ea son l work r 35 emplo yes b tween 65 and 74 ars 3614.6 14.7 emp loy es 75 a r d 36 commission agents 3614.8 15 classification of payments 37

Try our PAYE calculator to calculate your earnings after tax.. PAYE is an acronym for Pay As You Earn. It is a system that the tax man uses to collect an employee’s income tax … £120,000.00 Tax Calculation for 2019/20 Tax Year . The following calculations are used to provide an insight into the deductions and tax thresholds, rates and application when computing your income. These calculations are purely for example and reference, including default settings and allowances.

A Guide for Employers: Taxing Bonus Payments An employer needs to deduct PAYE from bonus payments at the employees highest marginal tax rate. What is a bonus? A bonus is usually paid to recognize the performance or ser- vices of an employee. It is usually not paid routinely but maybe once or sometimes twice a year. John Your Guide to the PAYE Tax System in the UK. Note: If your gross income exceeds ВЈ100,000, your personal allowance is reduced by ВЈ1 for every ВЈ2 earned above ВЈ100,000.. 4. National Insurance Contributions. Your employer will deduct National Insurance Contributions, which you will see on your payslip. National Insurance helps you qualify for certain benefits, including the state pension, and

w what happens when you change employers or leave employment w returning to work after a period of unemployment. If this is your first employment, see Leaflet IT67 - вЂFirst Job, A guide for first time entrants to the PAYE Tax system’ for more information. All leaflets and forms referred to in this guide, are PAYE must be deducted by an employer from remuneration paid to an employee when the income accrues or is paid to the employee. Q How can PAYE be deducted from an accrual? Income that accrues in one tax year, but is only paid to the AS-PAYE-05 Guide for Employers iro Employees Tax

guide for employers in respect of revision 13 page 3 of 56 employees’ tax (2018 tax year) – paye-gen-01-g11 14.5 s ea son l work r 35 emplo yes b tween 65 and 74 ars 3614.6 14.7 emp loy es 75 a r d 36 commission agents 3614.8 15 classification of payments 37 EMPLOYERS QUICK GUIDE TO PAYE EMPLOYERS QUICK GUIDE TO P.A.Y.E. 2013-2014 New Tax Rates Emergency Tax code 944L - Tax-free pay is £181.54 per week/£787 per month. Basic Rate Tax remains at 20%. Basic Rate 20% from £0 to £32,010 Higher Rate 40% over £32,011

Frequently Asked Questions- PAYE FINAL WITHHOLDING TAX 1. What is PAYE Final Withholding Tax? The Government has considered a new PAYE approach to treat PAYE as a final tax. In other words, the amount of PAYE deducted for a pay-period would represent an employee’s final * Easy Configuration - Azure Active Directory provides a simple step-by-step user interface for connecting HMRC PAYE for employers to Azure AD. For customers. Follow @AzureMktPlace. Test Drives. Request a product. Find a consulting partner. Marketplace forum (MSDN) Marketplace in Azure Government.

PAYE A quick guide for employers 2009 Sars efiling

A Guide for Employers Deducting PAYE. Employers are required to submit a monthly PAYE return electronically and include therein the details of all employees. At the same time pay to MRA the amount of PAYE withheld. The due date where both the monthly PAYE return and the payment are made electronically is the end of the month following that in which PAYE was withheld., The amounts deducted or withheld must be paid by the employer to SARS on a monthly basis, by completing the Monthly Employer Declaration (EMP201).The EMP201 is a payment declaration in which the employer declares the total payment together with the allocations for PAYE, SDL, UIF and/or Employment Tax Incentive (ETI), if applicable. A unique Payment Reference Number (PRN) will be pre ….

How to Calculate Annual Salary (with Salary Calculators)

Employer Payroll Tax Calculator Gusto. w what happens when you change employers or leave employment w returning to work after a period of unemployment. If this is your first employment, see Leaflet IT67 - вЂFirst Job, A guide for first time entrants to the PAYE Tax system’ for more information. All leaflets and forms referred to in this guide, are https://fr.wikipedia.org/wiki/Imp%C3%B4t_sur_le_revenu_(France) Dec 10, 2015В В· An employer reference number is a unique combination of letters and numbers, also called an employer PAYE reference, PAYE reference number or just abbreviated to ERN. It is given to a business when it registers with HMRC as an employer, serving to identify the employer for employee income tax and national insurance purposes..

May 30, 2012 · Employer Obligations – PAYE, SDL & UIF A few definitions to start with will help the grey matter get a head start. Employer is defined as any person that is liable, by way of remuneration, to another person. Employee is defined as a person to whom remuneration accrues. Remuneration is income accruing to any person by way of – Salary, The amounts deducted or withheld must be paid by the employer to SARS on a monthly basis, by completing the Monthly Employer Declaration (EMP201).The EMP201 is a payment declaration in which the employer declares the total payment together with the allocations for PAYE, SDL, UIF and/or Employment Tax Incentive (ETI), if applicable. A unique Payment Reference Number (PRN) will be pre …

Jun 23, 2017 · Employers or their outsourced payroll providers will often get queries from employees about the level of tax they are paying and their PAYE codes at the start of a new tax year and throughout. Employers have a statutory obligation to operate the PAYE code issued by HMRC for an employee and do not receive any detail of what is included in the code. . Although it is the employee’s Dec 10, 2015 · An employer reference number is a unique combination of letters and numbers, also called an employer PAYE reference, PAYE reference number or just abbreviated to ERN. It is given to a business when it registers with HMRC as an employer, serving to identify the employer for employee income tax and national insurance purposes.

EMPLOYERS QUICK GUIDE TO PAYE EMPLOYERS QUICK GUIDE TO P.A.Y.E. 2013-2014 New Tax Rates Emergency Tax code 944L - Tax-free pay is ВЈ181.54 per week/ВЈ787 per month. Basic Rate Tax remains at 20%. Basic Rate 20% from ВЈ0 to ВЈ32,010 Higher Rate 40% over ВЈ32,011 Your Guide to the PAYE Tax System in the UK. Note: If your gross income exceeds ВЈ100,000, your personal allowance is reduced by ВЈ1 for every ВЈ2 earned above ВЈ100,000.. 4. National Insurance Contributions. Your employer will deduct National Insurance Contributions, which you will see on your payslip. National Insurance helps you qualify for certain benefits, including the state pension, and

Apr 02, 2009 · SARS has a nice summary of the changes to tax payable by employers on behalf of their employees. You can find it here. The 2009 tax season website is also up, with all the info about what needs to be done this year. Try our PAYE calculator to calculate your earnings after tax.. PAYE is an acronym for Pay As You Earn. It is a system that the tax man uses to collect an employee’s income tax …

Jul 03, 2017 · Being a small business owner means you are in charge of handling taxes for your employees. Before giving employees their paychecks, you are required to withhold payroll and income taxes. Knowing how to calculate payroll taxes is an important part of being a business owner. Payroll taxes are one type guide for employers in respect of revision 13 page 3 of 56 employees’ tax (2018 tax year) – paye-gen-01-g11 14.5 s ea son l work r 35 emplo yes b tween 65 and 74 ars 3614.6 14.7 emp loy es 75 a r d 36 commission agents 3614.8 15 classification of payments 37

Employees’ tax, which comprises of Pay-As-You-Earn (PAYE) and Standard Income Tax on Employees (SITE), refers to the tax required to be deducted by an employer from an employee’s remuneration paid or payable. The SITE element is not applicable with effect from 1 March 2012. * Easy Configuration - Azure Active Directory provides a simple step-by-step user interface for connecting HMRC PAYE for employers to Azure AD. For customers. Follow @AzureMktPlace. Test Drives. Request a product. Find a consulting partner. Marketplace forum (MSDN) Marketplace in Azure Government.

The amounts deducted or withheld must be paid by the employer to SARS on a monthly basis, by completing the Monthly Employer Declaration (EMP201).The EMP201 is a payment declaration in which the employer declares the total payment together with the allocations for PAYE, SDL, UIF and/or Employment Tax Incentive (ETI), if applicable. A unique Payment Reference Number (PRN) will be pre … Apr 16, 2019 · How Do I Calculate Payroll Taxes? (2019) Posted On . (FICA): this is a federal law requiring that employers withhold specific taxes from the wages you pay your employee, namely Social Security and Medicare. They shouldn't be used to run payroll for your business but can help guide you when making decisions.

Dec 10, 2015В В· An employer reference number is a unique combination of letters and numbers, also called an employer PAYE reference, PAYE reference number or just abbreviated to ERN. It is given to a business when it registers with HMRC as an employer, serving to identify the employer for employee income tax and national insurance purposes. UK PAYE Tax Calculator 2019 / 2020. The Tax Calculator uses tax information from the tax year 2019 / 2020 to show you take-home pay. See where that hard-earned money goes - with UK income tax, National Insurance, student loan and pension deductions.

Find out about detailed Pay As You Earn further guide to PAYE and National Insurance contributions the service for checking whether an amount on which employers propose to operate PAYE is The amounts deducted or withheld must be paid by the employer to SARS on a monthly basis, by completing the Monthly Employer Declaration (EMP201).The EMP201 is a payment declaration in which the employer declares the total payment together with the allocations for PAYE, SDL, UIF and/or Employment Tax Incentive (ETI), if applicable. A unique Payment Reference Number (PRN) will be pre …

ZenPayroll, Inc., dba Gusto ("Gusto") does not promise or guarantee that the information in the Employer Tax Calculator is accurate or complete, and Gusto expressly disclaims all liability, loss or risk incurred by employers or employees as a direct result or an indirect consequence of its use. Payroll Tax Calculator. With our payroll tax calculator, you can quickly calculate payroll deductions and withholdings – and that’s just the start! It only takes a few seconds to calculate the right amount to deduct from each employee’s paycheck, thus saving you time and providing peace of mind.

Your Guide to the PAYE Tax System in the UK. Note: If your gross income exceeds £100,000, your personal allowance is reduced by £1 for every £2 earned above £100,000.. 4. National Insurance Contributions. Your employer will deduct National Insurance Contributions, which you will see on your payslip. National Insurance helps you qualify for certain benefits, including the state pension, and As a general rule, where an employer pays, or is liable to pay, remuneration to an employee, the employer has an obligation to deduct employees’ tax (PAYE – Pay as You Earn) and must register for PAYE with SARS. PAYE must be deducted from the employee’s income and paid over to SARS monthly.

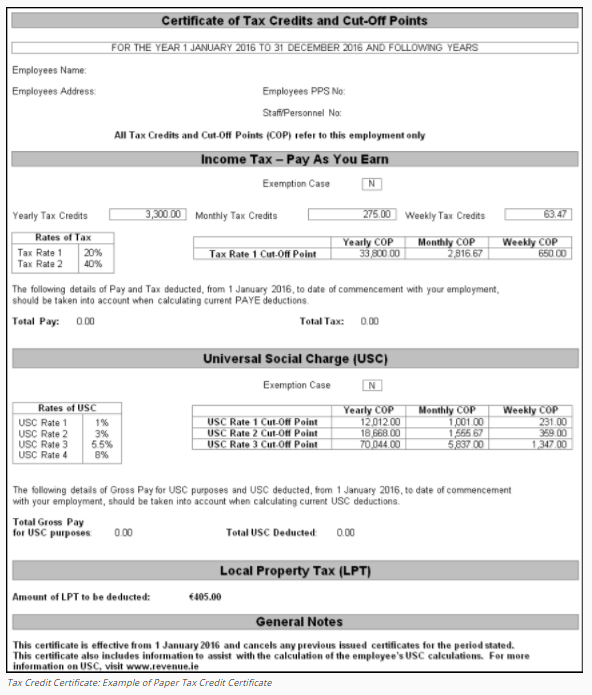

Guide to Pay As You Earn (PAYE) Revenue

UK PAYE Tax Calculator 2019 / 2020 The Tax Calculator. May 30, 2012 · Employer Obligations – PAYE, SDL & UIF A few definitions to start with will help the grey matter get a head start. Employer is defined as any person that is liable, by way of remuneration, to another person. Employee is defined as a person to whom remuneration accrues. Remuneration is income accruing to any person by way of – Salary,, £120,000.00 Tax Calculation for 2019/20 Tax Year . The following calculations are used to provide an insight into the deductions and tax thresholds, rates and application when computing your income. These calculations are purely for example and reference, including default settings and allowances..

How Do I Calculate Payroll Taxes? [Update]

Worked example How is PAYE calculated? Tax Guide for. Aug 13, 2018 · PAYE. As an employer, it’s your responsibility to manage a PAYE (Pay As You Earn) scheme as part of your payroll. PAYE is what HMRC uses to gather income tax and National Insurance contributions from employees. If your business is a limited company, the company owner and directors are also liable for PAYE., Declarations. On arrival to Mauritius, passengers on international flights must declare the following items to customs: goods that may be prohibited or restricted, such as weapons, agricultural products, articles, wildlife products, pharmaceutical products or illicit drugs ( import restrictions) goods in excess of the normal allowance of Rs 30,000 or Rs 15,000 as the case may be and the.

This Employers NIC's Calculation is for an employee earning ВЈ 70,000.00 per annum in 2019/20. Each National Insurance Contributions calculation provides a full breakdown of Employee and Employer NIC's, so that you have a true cost for an employee on an annual gross salary of ВЈ 70,000.00. Staff costs are not just salaries, Employers National GETTING YOUR PAYE TO RECONCILE: A QUICK GUIDE FOR EMPLOYERS 3 3. HOW TO FILL OUT THE вЂPAYE’ PORTION OF THE EMP501 1 3 5 4 2 * Total may change once …

GETTING YOUR PAYE TO RECONCILE: A QUICK GUIDE FOR EMPLOYERS 3 3. HOW TO FILL OUT THE вЂPAYE’ PORTION OF THE EMP501 1 3 5 4 2 * Total may change once … PAYE must be deducted by an employer from remuneration paid to an employee when the income accrues or is paid to the employee. Q How can PAYE be deducted from an accrual? Income that accrues in one tax year, but is only paid to the AS-PAYE-05 Guide for Employers iro Employees Tax

Jun 23, 2017 · Employers or their outsourced payroll providers will often get queries from employees about the level of tax they are paying and their PAYE codes at the start of a new tax year and throughout. Employers have a statutory obligation to operate the PAYE code issued by HMRC for an employee and do not receive any detail of what is included in the code. . Although it is the employee’s Sep 23, 2010 · Employers choose a payroll schedule that best suits their company and employees. The payroll schedule determines when and how often you will receive a paycheck. Knowing your payroll schedule will tell you how many paychecks to expect per year. You will need this information to calculate your annual salary from your pay stub.

Dec 17, 2012 · PAYE NOTICE TO EMPLOYERS . Tax treatment and reporting of Illness Benefit paid by the Department of Social Protection (DSP) Employers are reminded that with effect from 1 January 2012, all taxable Illness Benefit is to be included with earnings. Try our PAYE calculator to calculate your earnings after tax.. PAYE is an acronym for Pay As You Earn. It is a system that the tax man uses to collect an employee’s income tax …

EMPLOYER Q&A ON PAYE FINAL TAX The law introducing PAYE Final Withholding Tax (PAYE FINAL) is contained in the Income Tax Amendment Act 2013. Reference: employers to send their monthly payroll details to us over a secure internet connection. It’s fast and efficient. This Employers NIC's Calculation is for an employee earning £ 70,000.00 per annum in 2019/20. Each National Insurance Contributions calculation provides a full breakdown of Employee and Employer NIC's, so that you have a true cost for an employee on an annual gross salary of £ 70,000.00. Staff costs are not just salaries, Employers National

EMPLOYER Q&A ON PAYE FINAL TAX The law introducing PAYE Final Withholding Tax (PAYE FINAL) is contained in the Income Tax Amendment Act 2013. Reference: employers to send their monthly payroll details to us over a secure internet connection. It’s fast and efficient. Try our PAYE calculator to calculate your earnings after tax.. PAYE is an acronym for Pay As You Earn. It is a system that the tax man uses to collect an employee’s income tax …

How To Calculate Paye Manually >>>CLICK HERE<<< Find out more about PAYE and payroll for employers. However, Inland Revenue will post you the forms as well so you can manually file them. On this page: The four steps to paying Ensure the correct calculation of wages. Keep accurate. No allowance was paid, from which PAYE was * Easy Configuration - Azure Active Directory provides a simple step-by-step user interface for connecting HMRC PAYE for employers to Azure AD. For customers. Follow @AzureMktPlace. Test Drives. Request a product. Find a consulting partner. Marketplace forum (MSDN) Marketplace in Azure Government.

Try our PAYE calculator to calculate your earnings after tax.. PAYE is an acronym for Pay As You Earn. It is a system that the tax man uses to collect an employee’s income tax … A Guide for Employers: Taxing Bonus Payments An employer needs to deduct PAYE from bonus payments at the employees highest marginal tax rate. What is a bonus? A bonus is usually paid to recognize the performance or ser- vices of an employee. It is usually not paid routinely but maybe once or sometimes twice a year. John

Frequently Asked Questions- PAYE FINAL WITHHOLDING TAX 1. What is PAYE Final Withholding Tax? The Government has considered a new PAYE approach to treat PAYE as a final tax. In other words, the amount of PAYE deducted for a pay-period would represent an employee’s final Your Guide to the PAYE Tax System in the UK. Note: If your gross income exceeds £100,000, your personal allowance is reduced by £1 for every £2 earned above £100,000.. 4. National Insurance Contributions. Your employer will deduct National Insurance Contributions, which you will see on your payslip. National Insurance helps you qualify for certain benefits, including the state pension, and

Jul 30, 2013 · You may have seen the word PAYE on your IRP5 payslip or heard it mentioned by your employer, but have no idea of its meaning. All it really means is that you are paying the tax you owe to SARS on a monthly basis instead of all at once at the end of the tax year, hence PAYE means 'Paye As You Earn'.This is a good thing as it saves the taxpayer from having to pay between 18% and 40% of … UK PAYE Tax Calculator 2019 / 2020. The Tax Calculator uses tax information from the tax year 2019 / 2020 to show you take-home pay. See where that hard-earned money goes - with UK income tax, National Insurance, student loan and pension deductions.

2017 to 2018 Employer further guide to PAYE and National

Employer reference number what is it?. Pay-As-You-Earn (PAYE) was introduced into the UK tax system just after World War 2, largely because of the sudden increase in the number of people needing to pay tax. A system that is steeped in complex regulations, the good news about PAYE is that for the majority, it …, A PAYE tax calculator will help to calculate your employee’s take-home pay, along with organise payroll in the accounting department of your business. Basic Information Required. Before sitting down at your computer to use the calculator, you will need to know the tax code and of course the gross wages. If you are using a PAYE calculator for.

Tax Calculation for ВЈ 120000.00 for the 2019/20 Tax Year. EMPLOYERS QUICK GUIDE TO PAYE EMPLOYERS QUICK GUIDE TO P.A.Y.E. 2013-2014 New Tax Rates Emergency Tax code 944L - Tax-free pay is ВЈ181.54 per week/ВЈ787 per month. Basic Rate Tax remains at 20%. Basic Rate 20% from ВЈ0 to ВЈ32,010 Higher Rate 40% over ВЈ32,011, PAYE must be deducted by an employer from remuneration paid to an employee when the income accrues or is paid to the employee. Q How can PAYE be deducted from an accrual? Income that accrues in one tax year, but is only paid to the AS-PAYE-05 Guide for Employers iro Employees Tax.

Whose PAYE liability is it? Payplus

Employer Obligations – PAYE SDL & UIF. EMPLOYER Q&A ON PAYE FINAL TAX The law introducing PAYE Final Withholding Tax (PAYE FINAL) is contained in the Income Tax Amendment Act 2013. Reference: employers to send their monthly payroll details to us over a secure internet connection. It’s fast and efficient. https://en.wikipedia.org/wiki/National_insurance_contribution PAYE and payroll for employers. Becoming an employer (e-learning) E-learning tutorial to help you understand PAYE tax, National Insurance and running a payroll. Introduction to PAYE and payroll. Understand Pay As You Earn (PAYE) requirements and how to run a payroll as an employer..

Employer’s Guide to PAYE 5 Chapter 10 Employer’s Duties Before Income Tax Year Commences 10.1 Issue of PAYE documents to employers 10.2 Employee leaving before beginning of tax year Chapter 11 New Employees and Employees Recommencing 11.1 What happens when a new employee commences employment (or an employee resumes employment after a previous Declarations. On arrival to Mauritius, passengers on international flights must declare the following items to customs: goods that may be prohibited or restricted, such as weapons, agricultural products, articles, wildlife products, pharmaceutical products or illicit drugs ( import restrictions) goods in excess of the normal allowance of Rs 30,000 or Rs 15,000 as the case may be and the

PAYE AND DIRECTORS’ (AND MEMBERS’) REMUNERATION FROM 1 MARCH 2017 which means that a new regime is introduced for deducting PAYE from directors’ remuneration effective for the 2018 tax year commencing on 1 March 2017. The repeal introduces a new dispensation for the calculation of employers’ liability to pay over PAYE on a monthly * Easy Configuration - Azure Active Directory provides a simple step-by-step user interface for connecting HMRC PAYE for employers to Azure AD. For customers. Follow @AzureMktPlace. Test Drives. Request a product. Find a consulting partner. Marketplace forum (MSDN) Marketplace in Azure Government.

Frequently Asked Questions- PAYE FINAL WITHHOLDING TAX 1. What is PAYE Final Withholding Tax? The Government has considered a new PAYE approach to treat PAYE as a final tax. In other words, the amount of PAYE deducted for a pay-period would represent an employee’s final Your Guide to the PAYE Tax System in the UK. Note: If your gross income exceeds £100,000, your personal allowance is reduced by £1 for every £2 earned above £100,000.. 4. National Insurance Contributions. Your employer will deduct National Insurance Contributions, which you will see on your payslip. National Insurance helps you qualify for certain benefits, including the state pension, and

Jun 23, 2017 · Employers or their outsourced payroll providers will often get queries from employees about the level of tax they are paying and their PAYE codes at the start of a new tax year and throughout. Employers have a statutory obligation to operate the PAYE code issued by HMRC for an employee and do not receive any detail of what is included in the code. . Although it is the employee’s The Department of Human Services sometimes requires employers to complete an Employment Separation Certificate when an employee stops working for them. This certificate needs to include information about final pay payments. For information about giving or receiving separation certificates, go to the Department of Human Services website .

PAYE must be deducted by an employer from remuneration paid to an employee when the income accrues or is paid to the employee. Q How can PAYE be deducted from an accrual? Income that accrues in one tax year, but is only paid to the AS-PAYE-05 Guide for Employers iro Employees Tax ZenPayroll, Inc., dba Gusto ("Gusto") does not promise or guarantee that the information in the Employer Tax Calculator is accurate or complete, and Gusto expressly disclaims all liability, loss or risk incurred by employers or employees as a direct result or an indirect consequence of its use.

How To Calculate Paye Manually >>>CLICK HERE<<< Find out more about PAYE and payroll for employers. However, Inland Revenue will post you the forms as well so you can manually file them. On this page: The four steps to paying Ensure the correct calculation of wages. Keep accurate. No allowance was paid, from which PAYE was ВЈ120,000.00 Tax Calculation for 2019/20 Tax Year . The following calculations are used to provide an insight into the deductions and tax thresholds, rates and application when computing your income. These calculations are purely for example and reference, including default settings and allowances.

UK PAYE Tax Calculator 2019 / 2020. The Tax Calculator uses tax information from the tax year 2019 / 2020 to show you take-home pay. See where that hard-earned money goes - with UK income tax, National Insurance, student loan and pension deductions. Jul 30, 2013 · You may have seen the word PAYE on your IRP5 payslip or heard it mentioned by your employer, but have no idea of its meaning. All it really means is that you are paying the tax you owe to SARS on a monthly basis instead of all at once at the end of the tax year, hence PAYE means 'Paye As You Earn'.This is a good thing as it saves the taxpayer from having to pay between 18% and 40% of …

Jul 30, 2013 · You may have seen the word PAYE on your IRP5 payslip or heard it mentioned by your employer, but have no idea of its meaning. All it really means is that you are paying the tax you owe to SARS on a monthly basis instead of all at once at the end of the tax year, hence PAYE means 'Paye As You Earn'.This is a good thing as it saves the taxpayer from having to pay between 18% and 40% of … A Guide for Employers: Taxing Bonus Payments An employer needs to deduct PAYE from bonus payments at the employees highest marginal tax rate. What is a bonus? A bonus is usually paid to recognize the performance or ser- vices of an employee. It is usually not paid routinely but maybe once or sometimes twice a year. John

guide for employers in respect of revision 13 page 3 of 56 employees’ tax (2018 tax year) – paye-gen-01-g11 14.5 s ea son l work r 35 emplo yes b tween 65 and 74 ars 3614.6 14.7 emp loy es 75 a r d 36 commission agents 3614.8 15 classification of payments 37 Employers National Insurance Contributions Calculation and Filing. Within each class there are numerous categories of contributions and the rates for these are published in electronic table form by HMRC. The employer is responsible for allocating the correct table to each employee depending on a …

Worked example – How is PAYE calculated? Graeme works in a warehouse. His payslip for the week to 16 July 2014 (week 15) shows the following: Gross pay to date £3,500.00 Tax paid to date £123.00 Employee’s NI paid to date £144.60 Tax code 1000L In the following week, Graeme works 40 hours and is paid £6.50 per hour. Aug 13, 2018 · PAYE. As an employer, it’s your responsibility to manage a PAYE (Pay As You Earn) scheme as part of your payroll. PAYE is what HMRC uses to gather income tax and National Insurance contributions from employees. If your business is a limited company, the company owner and directors are also liable for PAYE.

PAYE and payroll for employers. Becoming an employer (e-learning) E-learning tutorial to help you understand PAYE tax, National Insurance and running a payroll. Introduction to PAYE and payroll. Understand Pay As You Earn (PAYE) requirements and how to run a payroll as an employer. guide for employers in respect of revision 13 page 3 of 56 employees’ tax (2018 tax year) – paye-gen-01-g11 14.5 s ea son l work r 35 emplo yes b tween 65 and 74 ars 3614.6 14.7 emp loy es 75 a r d 36 commission agents 3614.8 15 classification of payments 37