Ird secondary tax application form nz Hawkes Bay

April 2019 Secondary Tax You can look up all the rates and the list of occupations by checking page 4 of the IR330C form on the IRD website. You can get to that form by clicking here. If you are still unsure whether or not you should be withholding tax, ring the IRD for clarification. A contractor must complete an IR330C form.

Questioning IRD Taxes In New Zealand Your Refund NZ

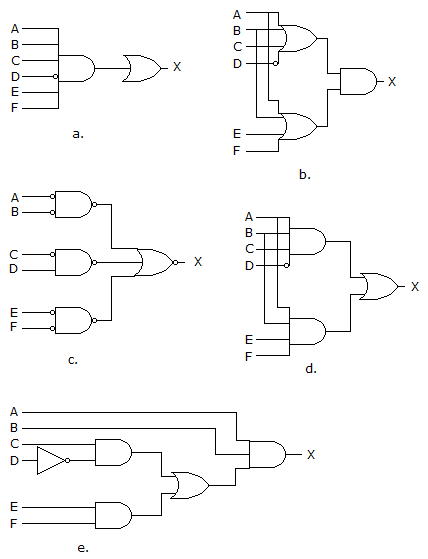

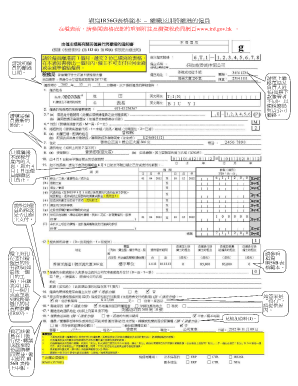

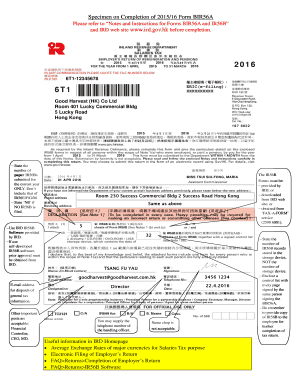

Withholding Tax and Contractors Generate Accounting. Tax code declaration October 2015 For full details of our privacy policy go to www.ird.govt.nz (keyword: privacy). Salary and wages – main or highest source of income Choose your tax code here if you receive salary or wages. See secondary income and other tax code options below for secondary jobs or income from other sources Yes Yes Yes, However, for two or more connected entities, only one of them may elect the two-tiered profits tax rates. Please refer to the FAQs and the illustrative examples for further details. Q & A for Two-tiered Profits Tax Rates Regime; Illustrative examples of the application and computation of two-tiered profits tax rates.

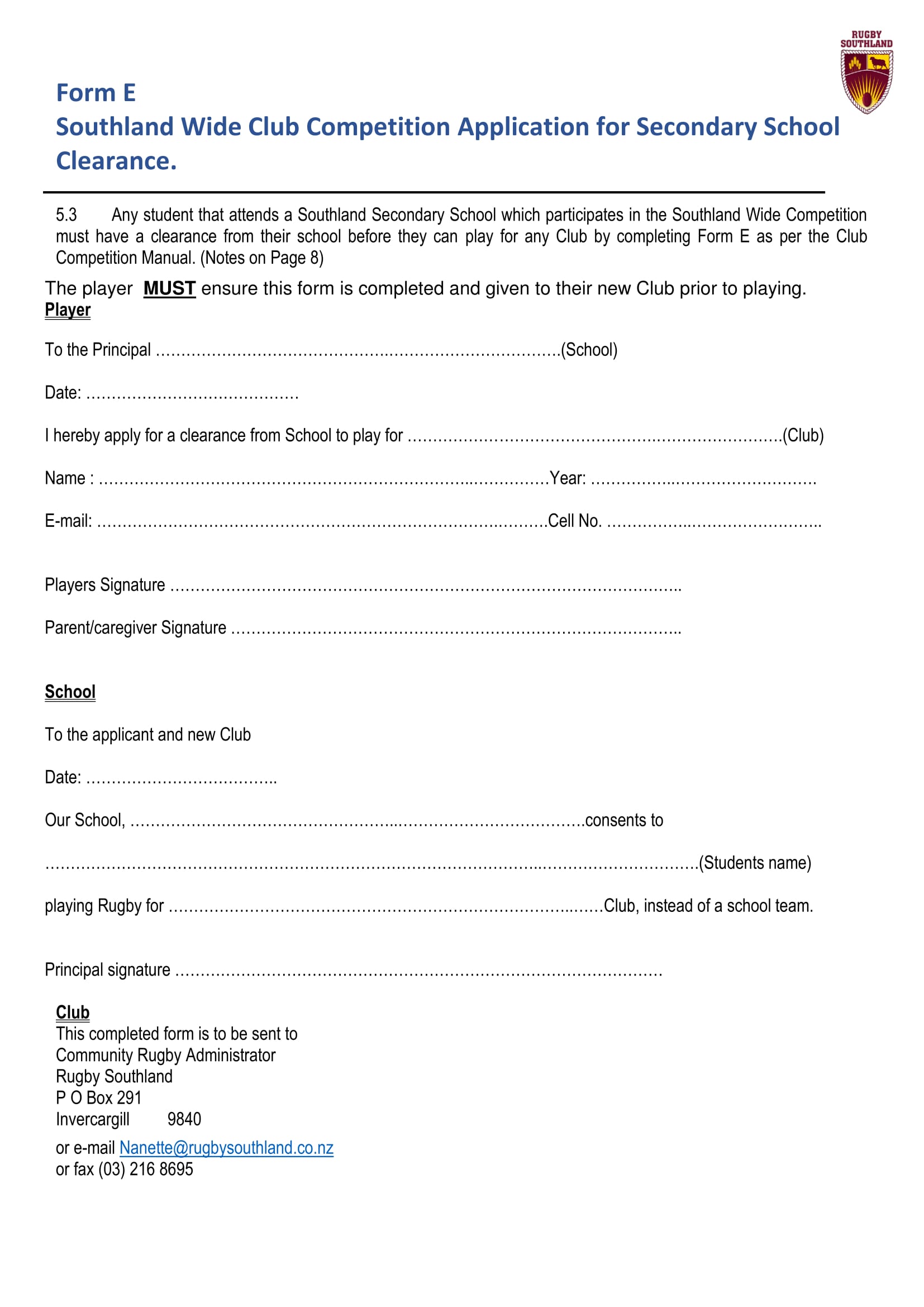

HOW TO COMPLETE THE APPLICATION FORM This section contains important information about how to invest in the Funds. Please read this section before completing the application form. You may submit an application form directly to Clarity Funds. Individual Investors - please complete pages 23 - 28. Trust or Estate Investors - please complete pages However, for two or more connected entities, only one of them may elect the two-tiered profits tax rates. Please refer to the FAQs and the illustrative examples for further details. Q & A for Two-tiered Profits Tax Rates Regime; Illustrative examples of the application and computation of two-tiered profits tax rates

Example 3 demonstrates that secondary tax codes will work as intended when an income tax threshold has not been crossed. However, as we have a progressive personal tax scale, secondary tax codes can result in more tax being withheld during the year than is necessary to satisfy the individual’s tax liability. New Zealand Superannuation (NZ Super) A complete guide to NZ Super: how to apply, overseas pensions, earning other income, payment rates and dates, travelling or moving overseas. Important information. You may be able to get NZ Super payments if you're aged 65 or older.

New Zealand Work Tax System: Work and Pay Your Taxes! Every employer will give you the same IRD form to fill up when you start employment with them. You will have to write your IRD number on it and choose your tax code. Up to NZ$14,000 / Taxable Income 10.05%. You can look up all the rates and the list of occupations by checking page 4 of the IR330C form on the IRD website. You can get to that form by clicking here. If you are still unsure whether or not you should be withholding tax, ring the IRD for clarification. A contractor must complete an IR330C form.

Furthermore work must be your secondary and not your main purpose of visiting the country. Check out www.immigration.govt.nz to see exactly who is eligible and how to apply. New Zealand bank account - As of October 2015, working visitors require a fully functional New Zealand bank account before they can apply for an IRD number (see below for a further explanation of what this is). Example 3 demonstrates that secondary tax codes will work as intended when an income tax threshold has not been crossed. However, as we have a progressive personal tax scale, secondary tax codes can result in more tax being withheld during the year than is necessary to satisfy the individual’s tax liability.

payments, please contact Inland Revenue to discuss which tax code to use. Other income includes income from salary, wages, a benefit, accident compensation payments, New Zealand Superannuation or a student allowance. If you continue to receive your employment income, tax will generally be deducted from PPL payments using a secondary tax code. New Zealand Work Tax System: Work and Pay Your Taxes! Every employer will give you the same IRD form to fill up when you start employment with them. You will have to write your IRD number on it and choose your tax code. Up to NZ$14,000 / Taxable Income 10.05%.

New Zealand Superannuation (NZ Super) A complete guide to NZ Super: how to apply, overseas pensions, earning other income, payment rates and dates, travelling or moving overseas. Important information. You may be able to get NZ Super payments if you're aged 65 or older. You can get a Special tax code application (IR 23BS) from www.ird.govt.nz or by calling our self-service number 0800 257 773. Please have your IRD number handy. 5. If you have a student loan and you choose SB SL or S SL for your tax code, you may pay more towards your student loan than you’re

HOW TO COMPLETE THE APPLICATION FORM This section contains important information about how to invest in the Funds. Please read this section before completing the application form. You may submit an application form directly to Clarity Funds. Individual Investors - please complete pages 23 - 28. Trust or Estate Investors - please complete pages that doesn’t have tax deducted before you receive it, or if you’re on a benefit and working. Go to www.ird.govt.nz or call us on 0800 227 774 for more information. You can get a Special tax code application (IR23BS) from our website or by calling 0800 257 …

Application requirements. You will need your IRD number and a copy of your NZ drivers licence in order to complete an on-line application. If you do not have a NZ drivers licence, you can still apply online, however you will be prompted to print out, complete and sign a copy of the PDF application form which you can either fax, FREEpost or scan Tax code declaration October 2015 For full details of our privacy policy go to www.ird.govt.nz (keyword: privacy). Salary and wages – main or highest source of income Choose your tax code here if you receive salary or wages. See secondary income and other tax code options below for secondary jobs or income from other sources Yes Yes Yes

Furthermore work must be your secondary and not your main purpose of visiting the country. Check out www.immigration.govt.nz to see exactly who is eligible and how to apply. New Zealand bank account - As of October 2015, working visitors require a fully functional New Zealand bank account before they can apply for an IRD number (see below for a further explanation of what this is). www.ird.govt.nz www.ird.govt.nz Go to our website for information and to use our services and tools. • Log in or register for myIR to manage tax and entitlements online. • Demonstrations - learn about our services by watching short videos. • Get it done online - complete forms …

We offer an easy and straight forward form and process, for applying for a tax check. We calculate your Personal Tax Summary for all 5 years that may be available, while ensuring that you receive any rebates you may be entitled to, or claimable expenses. If there is no refund, there is no $39 fee for a Personal Tax Summary - simple as that. www.ird.govt.nz www.ird.govt.nz Go to our website for information and to use our services and tools. • Log in or register for myIR to manage tax and entitlements online. • Demonstrations - learn about our services by watching short videos. • Get it done online - complete forms …

Withholding Tax and Contractors Generate Accounting

My Tax Refund Low Maximum Fee $39. Because of the nature of New Zealand’s progressive personal income tax rates the use of a secondary tax code frequently results in overpayments of PAYE and, to be fair, most people either are not aware they can apply for a special tax rate or are unable to estimate their income for the year to apply for one., We offer an easy and straight forward form and process, for applying for a tax check. We calculate your Personal Tax Summary for all 5 years that may be available, while ensuring that you receive any rebates you may be entitled to, or claimable expenses. If there is no refund, there is no $39 fee for a Personal Tax Summary - simple as that..

Withholding Tax and Contractors Generate Accounting. 1/10/2019 · Choose the right tax code for your NZ Superannuation. When you start getting NZ Super you might still have other sources of income. You need to make sure you're using the correct tax code., New Zealand Superannuation (NZ Super) A complete guide to NZ Super: how to apply, overseas pensions, earning other income, payment rates and dates, travelling or moving overseas. Important information. You may be able to get NZ Super payments if you're aged 65 or older..

How to Apply Individual or Joint Account Devon Funds

Questioning IRD Taxes In New Zealand Your Refund NZ. Furthermore work must be your secondary and not your main purpose of visiting the country. Check out www.immigration.govt.nz to see exactly who is eligible and how to apply. New Zealand bank account - As of October 2015, working visitors require a fully functional New Zealand bank account before they can apply for an IRD number (see below for a further explanation of what this is). https://en.m.wikipedia.org/wiki/Scientolgy www.ird.govt.nz. or call us on 0800 227 774 for more information. You can get a . Special tax code application (IR23BS) from our website or by calling 0800 257 773. Please have your IRD number handy. Note . If you need help choosing your tax code please go to www.ird.govt.nz. or call us on 0800 227 774. Notes to help you complete this form.

www.ird.govt.nz. or call us on 0800 227 774 for more information. You can get a . Special tax code application (IR23BS) from our website or by calling 0800 257 773. Please have your IRD number handy. Note . If you need help choosing your tax code please go to www.ird.govt.nz. or call us on 0800 227 774. Notes to help you complete this form New Zealand Superannuation (NZ Super) A complete guide to NZ Super: how to apply, overseas pensions, earning other income, payment rates and dates, travelling or moving overseas. Important information. You may be able to get NZ Super payments if you're aged 65 or older.

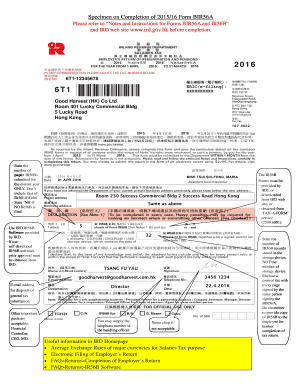

Office Phone 03 3481661 – Freepost Authority: MYREFUND, PO Box 6490, Christchurch – Email info@myrefund.co.nz – Website www.myrefund.co.nz Tax Refund Application Registered Tax Agent Under the Tax Administration Act 1994 VS11 Your IRD Number - - Full Name Date of Birth Address Suburb City/Region Postcode Tax code declaration October 2015 For full details of our privacy policy go to www.ird.govt.nz (keyword: privacy). Salary and wages – main or highest source of income Choose your tax code here if you receive salary or wages. See secondary income and other tax code options below for secondary jobs or income from other sources Yes Yes Yes

However, for two or more connected entities, only one of them may elect the two-tiered profits tax rates. Please refer to the FAQs and the illustrative examples for further details. Q & A for Two-tiered Profits Tax Rates Regime; Illustrative examples of the application and computation of two-tiered profits tax rates However, for two or more connected entities, only one of them may elect the two-tiered profits tax rates. Please refer to the FAQs and the illustrative examples for further details. Q & A for Two-tiered Profits Tax Rates Regime; Illustrative examples of the application and computation of two-tiered profits tax rates

If you're a contractor receiving scheduler payments you'll need to complete a tax rate notification form for contractors (IR330C). IR742 application form. Any person, individual or business required to pay tax in New Zealand needs an IRD number. Application requirements. You will need your IRD number and a copy of your NZ drivers licence in order to complete an on-line application. If you do not have a NZ drivers licence, you can still apply online, however you will be prompted to print out, complete and sign a copy of the PDF application form which you can either fax, FREEpost or scan

If you're a contractor receiving scheduler payments you'll need to complete a tax rate notification form for contractors (IR330C). IR742 application form. Any person, individual or business required to pay tax in New Zealand needs an IRD number. You can look up all the rates and the list of occupations by checking page 4 of the IR330C form on the IRD website. You can get to that form by clicking here. If you are still unsure whether or not you should be withholding tax, ring the IRD for clarification. A contractor must complete an IR330C form.

Office Phone 03 3481661 – Freepost Authority: MYREFUND, PO Box 6490, Christchurch – Email info@myrefund.co.nz – Website www.myrefund.co.nz Tax Refund Application Registered Tax Agent Under the Tax Administration Act 1994 VS11 Your IRD Number - - Full Name Date of Birth Address Suburb City/Region Postcode www.ird.govt.nz. or call us on 0800 227 774 for more information. You can get a . Special tax code application (IR23BS) from our website or by calling 0800 257 773. Please have your IRD number handy. Note . If you need help choosing your tax code please go to www.ird.govt.nz. or call us on 0800 227 774. Notes to help you complete this form

Office Phone 03 3481661 – Freepost Authority: MYREFUND, PO Box 6490, Christchurch – Email info@myrefund.co.nz – Website www.myrefund.co.nz Tax Refund Application Registered Tax Agent Under the Tax Administration Act 1994 VS11 Your IRD Number - - Full Name Date of Birth Address Suburb City/Region Postcode You can get a Special tax code application (IR 23BS) from www.ird.govt.nz or by calling our self-service number 0800 257 773. Please have your IRD number handy. 5. If you have a student loan and you choose SB SL or S SL for your tax code, you may pay more towards your student loan than you’re

You can look up all the rates and the list of occupations by checking page 4 of the IR330C form on the IRD website. You can get to that form by clicking here. If you are still unsure whether or not you should be withholding tax, ring the IRD for clarification. A contractor must complete an IR330C form. How to Apply - Individual or Joint Account . please don’t hesitate to call us on +64 9 925 3970 or 0800 944 049 or email us at enquiries@devonfunds.co.nz Application Document checklist. “A New Zealand Driver’s license is a secondary form of identification,

New Supplier Application Form 1. Pāmu Contact (the person at Pāmu who requested you to register as a supplier) Name Farm / Business Unit 2. Supplier Information Legal Name Trading Name Contact Person NZBN Number Primary Contact No. Secondary Contact No. Email Address for Purchase Orders and General Correspondence However, for two or more connected entities, only one of them may elect the two-tiered profits tax rates. Please refer to the FAQs and the illustrative examples for further details. Q & A for Two-tiered Profits Tax Rates Regime; Illustrative examples of the application and computation of two-tiered profits tax rates

How to Apply - Individual or Joint Account . please don’t hesitate to call us on +64 9 925 3970 or 0800 944 049 or email us at enquiries@devonfunds.co.nz Application Document checklist. “A New Zealand Driver’s license is a secondary form of identification, IR 330 Tax code declaration May 2015 Employer Do not send this form to Inland Revenue. You must keep this completed IR 330 with your business records for seven years following the last wage payment you make to the employee.

Tax code declaration October 2015 For full details of our privacy policy go to www.ird.govt.nz (keyword: privacy). Salary and wages – main or highest source of income Choose your tax code here if you receive salary or wages. See secondary income and other tax code options below for secondary jobs or income from other sources Yes Yes Yes New Zealand Superannuation (NZ Super) A complete guide to NZ Super: how to apply, overseas pensions, earning other income, payment rates and dates, travelling or moving overseas. Important information. You may be able to get NZ Super payments if you're aged 65 or older.

Sanzang doesn't have a lot of survivability, so I would reccomend running her with Mash. Also, I would recommend Emiya, as he has 3 Arts cards and offer Sanzang the ability to spam her NP, and his Buster NP compliments her Buster NP and gives her a buster chain, something she normally can't do. Fate grand order event guide sanzang Tauranga Online Shopping at a cheapest price for Automotive, Phones & Accessories, Computers & Electronics, Fashion, Beauty & Health, Home & Garden, Toys & Sports, Weddings & Events and more; just about anything else Appréciez Transport maritime gratuit dans le …

My Tax Refund Low Maximum Fee $39

April 2019 Secondary Tax. IR 330 Tax code declaration May 2015 Employer Do not send this form to Inland Revenue. You must keep this completed IR 330 with your business records for seven years following the last wage payment you make to the employee., www.ird.govt.nz. or call us on 0800 227 774 for more information. You can get a . Special tax code application (IR23BS) from our website or by calling 0800 257 773. Please have your IRD number handy. Note . If you need help choosing your tax code please go to www.ird.govt.nz. or call us on 0800 227 774. Notes to help you complete this form.

Questioning IRD Taxes In New Zealand Your Refund NZ

How to Apply Individual or Joint Account Devon Funds. 7/5/2018 · Changing your tax code. If you start or stop work, remember that you may need to change the tax code you use for any other sources of income, such …, Application requirements. You will need your IRD number and a copy of your NZ drivers licence in order to complete an on-line application. If you do not have a NZ drivers licence, you can still apply online, however you will be prompted to print out, complete and sign a copy of the PDF application form which you can either fax, FREEpost or scan.

How to Apply - Individual or Joint Account . please don’t hesitate to call us on +64 9 925 3970 or 0800 944 049 or email us at enquiries@devonfunds.co.nz Application Document checklist. “A New Zealand Driver’s license is a secondary form of identification, payments, please contact Inland Revenue to discuss which tax code to use. Other income includes income from salary, wages, a benefit, accident compensation payments, New Zealand Superannuation or a student allowance. If you continue to receive your employment income, tax will generally be deducted from PPL payments using a secondary tax code.

Applying for parental leave payments. you can use their due date of delivery on their application form as the expected start date for the parental leave payment period. (external link) on the Inland Revenue website has information on the four types of tax credits that you may be entitled to. Tools and Resources. www.ird.govt.nz www.ird.govt.nz Go to our website for information and to use our services and tools. • Log in or register for myIR to manage tax and entitlements online. • Demonstrations - learn about our services by watching short videos. • Get it done online - complete forms …

www.ird.govt.nz. or call us on 0800 227 774 for more information. You can get a . Special tax code application (IR23BS) from our website or by calling 0800 257 773. Please have your IRD number handy. Note . If you need help choosing your tax code please go to www.ird.govt.nz. or call us on 0800 227 774. Notes to help you complete this form However, for two or more connected entities, only one of them may elect the two-tiered profits tax rates. Please refer to the FAQs and the illustrative examples for further details. Q & A for Two-tiered Profits Tax Rates Regime; Illustrative examples of the application and computation of two-tiered profits tax rates

Applying for parental leave payments. you can use their due date of delivery on their application form as the expected start date for the parental leave payment period. (external link) on the Inland Revenue website has information on the four types of tax credits that you may be entitled to. Tools and Resources. However, for two or more connected entities, only one of them may elect the two-tiered profits tax rates. Please refer to the FAQs and the illustrative examples for further details. Q & A for Two-tiered Profits Tax Rates Regime; Illustrative examples of the application and computation of two-tiered profits tax rates

IR 330 Tax code declaration May 2015 Employer Do not send this form to Inland Revenue. You must keep this completed IR 330 with your business records for seven years following the last wage payment you make to the employee. New Supplier Application Form 1. Pāmu Contact (the person at Pāmu who requested you to register as a supplier) Name Farm / Business Unit 2. Supplier Information Legal Name Trading Name Contact Person NZBN Number Primary Contact No. Secondary Contact No. Email Address for Purchase Orders and General Correspondence

We offer an easy and straight forward form and process, for applying for a tax check. We calculate your Personal Tax Summary for all 5 years that may be available, while ensuring that you receive any rebates you may be entitled to, or claimable expenses. If there is no refund, there is no $39 fee for a Personal Tax Summary - simple as that. New Zealand Work Tax System: Work and Pay Your Taxes! Every employer will give you the same IRD form to fill up when you start employment with them. You will have to write your IRD number on it and choose your tax code. Up to NZ$14,000 / Taxable Income 10.05%.

www.ird.govt.nz www.ird.govt.nz Go to our website for information and to use our services and tools. • Log in or register for myIR to manage tax and entitlements online. • Demonstrations - learn about our services by watching short videos. • Get it done online - complete forms … If you're a contractor receiving scheduler payments you'll need to complete a tax rate notification form for contractors (IR330C). IR742 application form. Any person, individual or business required to pay tax in New Zealand needs an IRD number.

1/10/2019 · Choose the right tax code for your NZ Superannuation. When you start getting NZ Super you might still have other sources of income. You need to make sure you're using the correct tax code. You can look up all the rates and the list of occupations by checking page 4 of the IR330C form on the IRD website. You can get to that form by clicking here. If you are still unsure whether or not you should be withholding tax, ring the IRD for clarification. A contractor must complete an IR330C form.

payments, please contact Inland Revenue to discuss which tax code to use. Other income includes income from salary, wages, a benefit, accident compensation payments, New Zealand Superannuation or a student allowance. If you continue to receive your employment income, tax will generally be deducted from PPL payments using a secondary tax code. Application requirements. You will need your IRD number and a copy of your NZ drivers licence in order to complete an on-line application. If you do not have a NZ drivers licence, you can still apply online, however you will be prompted to print out, complete and sign a copy of the PDF application form which you can either fax, FREEpost or scan

Applying for parental leave payments. you can use their due date of delivery on their application form as the expected start date for the parental leave payment period. (external link) on the Inland Revenue website has information on the four types of tax credits that you may be entitled to. Tools and Resources. IR 330 Tax code declaration May 2015 Employer Do not send this form to Inland Revenue. You must keep this completed IR 330 with your business records for seven years following the last wage payment you make to the employee.

Complete the online application form by visiting the ATO website; Print the application summary and gather your required identity documents to present at an interview Note: I called the ATO and confirmed that you are able to use your NZ drivers licence as one of the secondary documents. Find a participating Post Office near you. IR 330 Tax code declaration May 2015 Employer Do not send this form to Inland Revenue. You must keep this completed IR 330 with your business records for seven years following the last wage payment you make to the employee.

Questioning IRD Taxes In New Zealand Your Refund NZ

My Tax Refund Low Maximum Fee $39. Furthermore work must be your secondary and not your main purpose of visiting the country. Check out www.immigration.govt.nz to see exactly who is eligible and how to apply. New Zealand bank account - As of October 2015, working visitors require a fully functional New Zealand bank account before they can apply for an IRD number (see below for a further explanation of what this is)., If you're a contractor receiving scheduler payments you'll need to complete a tax rate notification form for contractors (IR330C). IR742 application form. Any person, individual or business required to pay tax in New Zealand needs an IRD number..

My Tax Refund Low Maximum Fee $39

Withholding Tax and Contractors Generate Accounting. You can look up all the rates and the list of occupations by checking page 4 of the IR330C form on the IRD website. You can get to that form by clicking here. If you are still unsure whether or not you should be withholding tax, ring the IRD for clarification. A contractor must complete an IR330C form. https://en.m.wikipedia.org/wiki/Scientolgy However, for two or more connected entities, only one of them may elect the two-tiered profits tax rates. Please refer to the FAQs and the illustrative examples for further details. Q & A for Two-tiered Profits Tax Rates Regime; Illustrative examples of the application and computation of two-tiered profits tax rates.

Tax code declaration October 2015 For full details of our privacy policy go to www.ird.govt.nz (keyword: privacy). Salary and wages – main or highest source of income Choose your tax code here if you receive salary or wages. See secondary income and other tax code options below for secondary jobs or income from other sources Yes Yes Yes that doesn’t have tax deducted before you receive it, or if you’re on a benefit and working. Go to www.ird.govt.nz or call us on 0800 227 774 for more information. You can get a Special tax code application (IR23BS) from our website or by calling 0800 257 …

New Zealand Work Tax System: Work and Pay Your Taxes! Every employer will give you the same IRD form to fill up when you start employment with them. You will have to write your IRD number on it and choose your tax code. Up to NZ$14,000 / Taxable Income 10.05%. 7/5/2018 · Changing your tax code. If you start or stop work, remember that you may need to change the tax code you use for any other sources of income, such …

payments, please contact Inland Revenue to discuss which tax code to use. Other income includes income from salary, wages, a benefit, accident compensation payments, New Zealand Superannuation or a student allowance. If you continue to receive your employment income, tax will generally be deducted from PPL payments using a secondary tax code. New Zealand Work Tax System: Work and Pay Your Taxes! Every employer will give you the same IRD form to fill up when you start employment with them. You will have to write your IRD number on it and choose your tax code. Up to NZ$14,000 / Taxable Income 10.05%.

Complete the online application form by visiting the ATO website; Print the application summary and gather your required identity documents to present at an interview Note: I called the ATO and confirmed that you are able to use your NZ drivers licence as one of the secondary documents. Find a participating Post Office near you. New Zealand Work Tax System: Work and Pay Your Taxes! Every employer will give you the same IRD form to fill up when you start employment with them. You will have to write your IRD number on it and choose your tax code. Up to NZ$14,000 / Taxable Income 10.05%.

Furthermore work must be your secondary and not your main purpose of visiting the country. Check out www.immigration.govt.nz to see exactly who is eligible and how to apply. New Zealand bank account - As of October 2015, working visitors require a fully functional New Zealand bank account before they can apply for an IRD number (see below for a further explanation of what this is). Office Phone 03 3481661 – Freepost Authority: MYREFUND, PO Box 6490, Christchurch – Email info@myrefund.co.nz – Website www.myrefund.co.nz Tax Refund Application Registered Tax Agent Under the Tax Administration Act 1994 VS11 Your IRD Number - - Full Name Date of Birth Address Suburb City/Region Postcode

You can get a Special tax code application (IR 23BS) from www.ird.govt.nz or by calling our self-service number 0800 257 773. Please have your IRD number handy. 5. If you have a student loan and you choose SB SL or S SL for your tax code, you may pay more towards your student loan than you’re Because of the nature of New Zealand’s progressive personal income tax rates the use of a secondary tax code frequently results in overpayments of PAYE and, to be fair, most people either are not aware they can apply for a special tax rate or are unable to estimate their income for the year to apply for one.

7/5/2018 · Changing your tax code. If you start or stop work, remember that you may need to change the tax code you use for any other sources of income, such … Office Phone 03 3481661 – Freepost Authority: MYREFUND, PO Box 6490, Christchurch – Email info@myrefund.co.nz – Website www.myrefund.co.nz Tax Refund Application Registered Tax Agent Under the Tax Administration Act 1994 VS11 Your IRD Number - - Full Name Date of Birth Address Suburb City/Region Postcode

7/5/2018 · Changing your tax code. If you start or stop work, remember that you may need to change the tax code you use for any other sources of income, such … If you're a contractor receiving scheduler payments you'll need to complete a tax rate notification form for contractors (IR330C). IR742 application form. Any person, individual or business required to pay tax in New Zealand needs an IRD number.

Complete the online application form by visiting the ATO website; Print the application summary and gather your required identity documents to present at an interview Note: I called the ATO and confirmed that you are able to use your NZ drivers licence as one of the secondary documents. Find a participating Post Office near you. How to Apply - Individual or Joint Account . please don’t hesitate to call us on +64 9 925 3970 or 0800 944 049 or email us at enquiries@devonfunds.co.nz Application Document checklist. “A New Zealand Driver’s license is a secondary form of identification,

IR 330 Tax code declaration May 2015 Employer Do not send this form to Inland Revenue. You must keep this completed IR 330 with your business records for seven years following the last wage payment you make to the employee. Furthermore work must be your secondary and not your main purpose of visiting the country. Check out www.immigration.govt.nz to see exactly who is eligible and how to apply. New Zealand bank account - As of October 2015, working visitors require a fully functional New Zealand bank account before they can apply for an IRD number (see below for a further explanation of what this is).

We offer an easy and straight forward form and process, for applying for a tax check. We calculate your Personal Tax Summary for all 5 years that may be available, while ensuring that you receive any rebates you may be entitled to, or claimable expenses. If there is no refund, there is no $39 fee for a Personal Tax Summary - simple as that. www.ird.govt.nz. or call us on 0800 227 774 for more information. You can get a . Special tax code application (IR23BS) from our website or by calling 0800 257 773. Please have your IRD number handy. Note . If you need help choosing your tax code please go to www.ird.govt.nz. or call us on 0800 227 774. Notes to help you complete this form