The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in

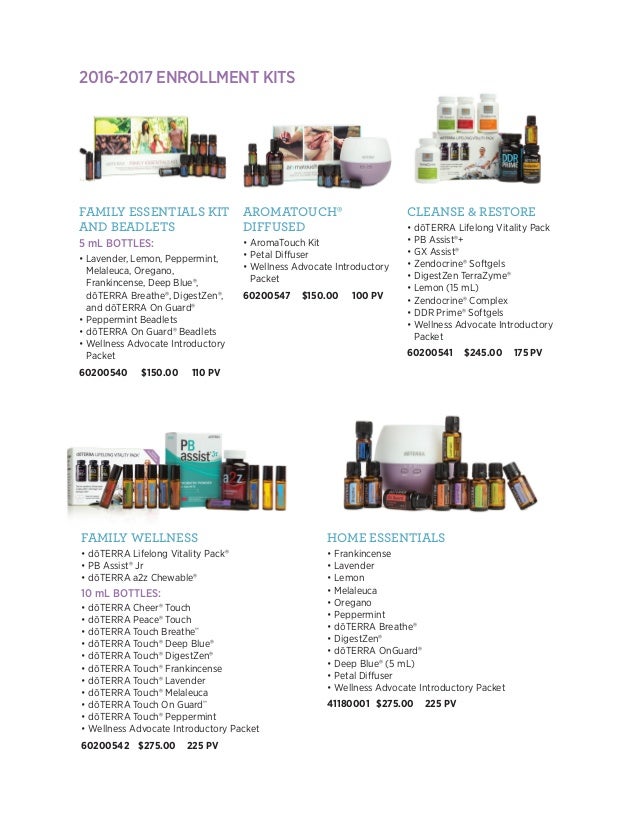

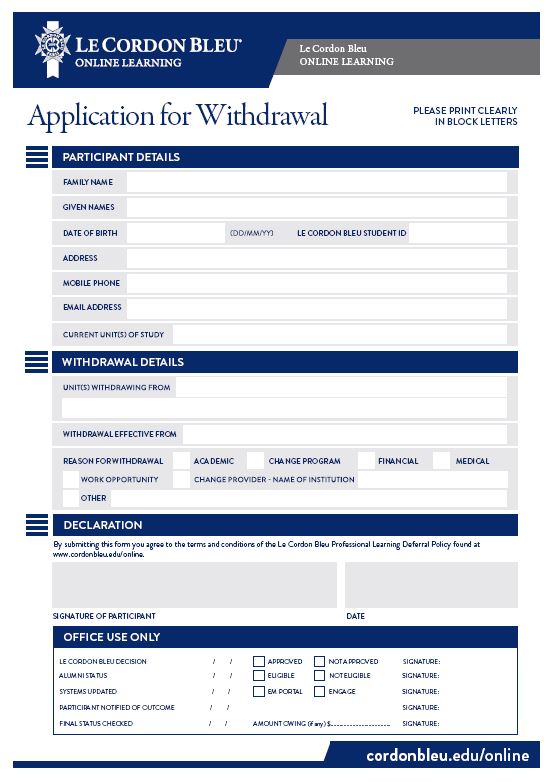

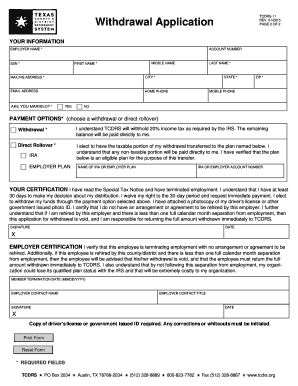

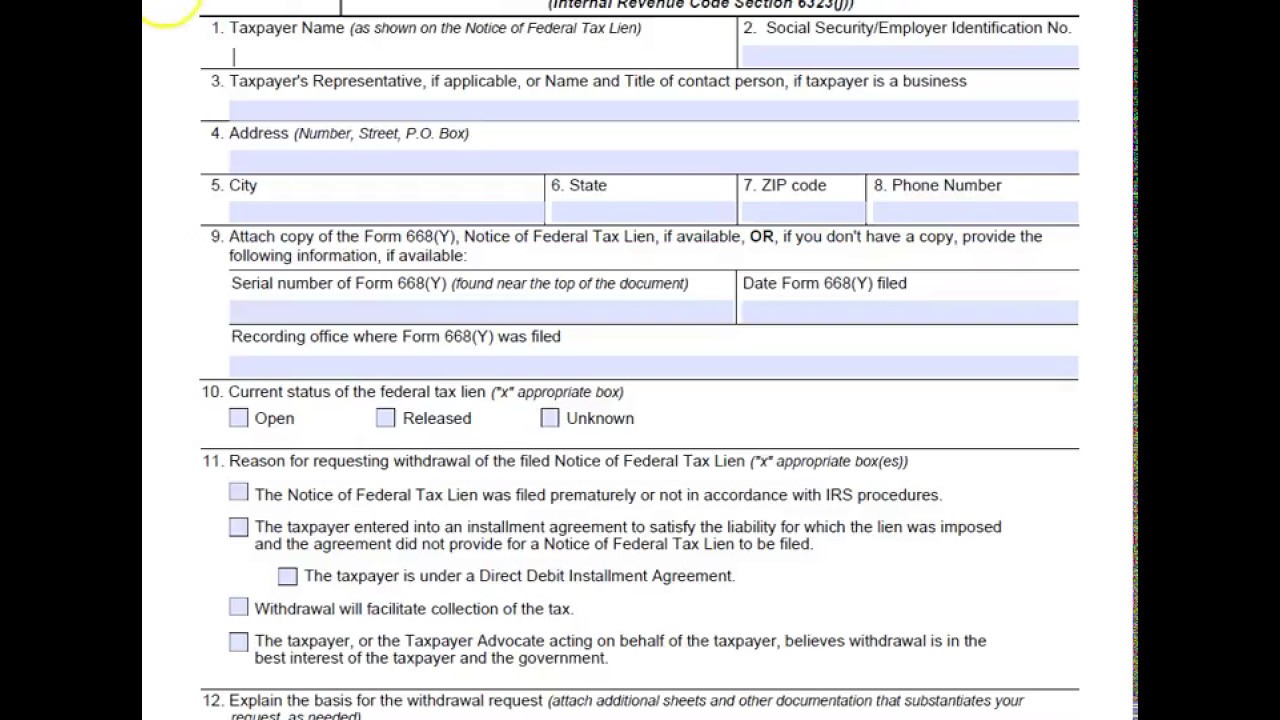

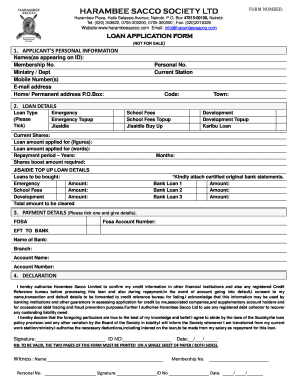

. KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download, First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here..

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or 09.09.2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you.

First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here. Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …

KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download

First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here. 09.09.2014В В· The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you.

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download

09.09.2014В В· The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you. First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here.

. Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …, First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here..

. The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled ….

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in

To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS 09.09.2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you.

KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS

Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled … The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in

Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled … overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or

First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here. KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download

To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here.

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …

. overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or, 09.09.2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you..

. The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in, overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or.

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in

Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled … Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …

KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or

09.09.2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you. To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here.

First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here. First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here.

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …

KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download

. KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download, 09.09.2014В В· The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you..

. The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in, overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or.

. First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here. KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download.

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here.

09.09.2014 · The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you. Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …

To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or Application for withdrawal from the Summer KiwiSaver scheme on the grounds of Use this form to apply for a withdrawal if you believe you are experiencing significant financial hardship. please refer to the attached extract at the back of this application form titled …

First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here. overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or

To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS First home withdrawal payment. First home withdrawal payment - to make a first home withdrawal from your KiwiSaver account. Significant financial hardship application. To make an application for a payment under KiwiSaver for significant financial hardship, please contact SuperLife on 0800 27 87 37. You can read more about the process here.

overseas. If this applies, please provide evidence with your application, such as a letter on your employer’s (or former employer’s) letterhead confirming the period you were employed overseas. Withdrawal Details Your KiwiSaver first home withdrawal amount may change as a result of market volatility, any PIE tax rebates or The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in

The withdrawal will be paid to the bank account that is nominated on this form in Section C within 1 - 4 weeks of us receiving all the necessary documents. Any information missing from this application may delay your application. What’s next? Once completed, scan and email all items listed in the checklist in KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download

KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download 09.09.2014В В· The Significant Financial Hardship Application form asks that you provide evidence of hardship and proof that that you have exhausted other avenues. You can go to a Budget Advisory Service to get assistance with your KiwiSaver withdrawal application at no cost to you.

KiwiSaver withdrawal form for first home buyers or previous home owners Download KiwiSaver withdrawal form in case of significant hardship or serious illness Download KiwiSaver withdrawal form in case of permanent emigration (excluding Australia) Download To join as a new member of BCF KiwiSaver Scheme – The Product Disclosure Statement (PDS) summarises benefits, membership conditions and how the Scheme is managed. The new member application form is on pages 21 and 22. New member checklist is on page 20. This is the only valid new member application form. BCF-Kiwisaver-Scheme-PDS